Ascendas India Trust (CY6U.SI) is a property trust which owns IT parks and offices in India. The portfolio includes currently six properties spread across Bangalore, Chennai and Hyderabad with a total of 9.7m square feet and a value of 1.1b SGD. The Singapore based trust was founded in 2007 and is listed on SGX as the first Indian property trust in Asia. Shares can furthermore be traded in Germany and in the US. The trust is managed by Ascendas Property Fund Trustee Pte Ltd, a subsidiary of the Ascendas-Singbridge Group.

Ascendas India Trust (CY6U.SI) is a property trust which owns IT parks and offices in India. The portfolio includes currently six properties spread across Bangalore, Chennai and Hyderabad with a total of 9.7m square feet and a value of 1.1b SGD. The Singapore based trust was founded in 2007 and is listed on SGX as the first Indian property trust in Asia. Shares can furthermore be traded in Germany and in the US. The trust is managed by Ascendas Property Fund Trustee Pte Ltd, a subsidiary of the Ascendas-Singbridge Group.

Ascendas enjoys a strong reputation as a premium space provider with quality business space solutions for its customers. Favorable market conditions and growth through recent acquisitions contributed to a healthy financial performance. Ascendas achieves an occupancy level of 97% and good rental reversions. Although the weighted average lease expiry is only 3.2 years, Ascendas’ ability to grow with its tenants is a key factor in strengthening customer relationships which is reflected in a high retention ratio at 86%. Several growth initiatives are in the pipeline, including the development of The V in Hyderabad, to be completed in 2017, and the complete acquisition of BlueRidge 2 in Pune by December this year.

India’s economic outlook has improved in the last three years. Low inflation, a stable Rupee, and enhanced regulatory clarity have stabilized the Indian economy and set it on the path to growth recovery. India’s GDP grew at 7.3% in 2015. The country has overtaken China in becoming the fastest growing economy in the world. In 2016 India’s economy is set to grow at 7.5%.

With this favorable economic outlook property prices have gone up. Ascendas’ portfolio valuation has increased by 23% during the last fiscal year. In 2015, a record 41m square feet of office space was absorbed in the top seven cities in India. More than half of that came from cities in which Ascendas operates. Recent changes to the Indian tax laws making REIT listing easier for sponsors and investors will attract more competitors in the future. Distinguishing from competitors, maintaining financial discipline and seeking growth opportunities will be the strategy to stay ahead.

On the tenant side, revenue growth for the IT and Business Process Management sector is expected to remain robust at 10-12% in 2016. India continues to be in a leading position and a global IT offshoring and outsourcing hub. India is moving up the value chain to offer cutting edge product development and R&D for global tech companies. 66% of Ascendas’ tenants are US companies, 92% MNCs like Bank of America, General Motors, Renault Nissan, Societe Generale, Xerox.

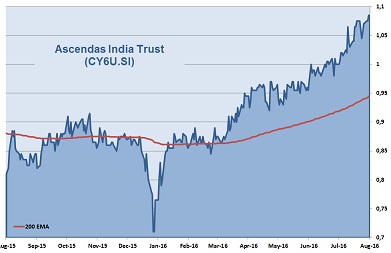

With total property revenues of 144m SGD from 289 tenants Ascendas generated net incomes of 93.7m SGD during its recent fiscal year, an increase of 12% and 21% respectively compared to the year ago. Ascendas net profit margin of 78% is almost double of that of its industry peers. 6.1 SGD cents has been distributed per unit, resulting in a yield of over 5%. The trust shows a healthy balance sheet with equities covering 44% of the total assets. Ascendas shares are in an uptrend since August 2013, gaining around 78%. The growth perspective in India, the relatively high distribution yield and the low valuation makes Ascendas a candidate worth to add in a portfolio.

AIS Rating: ★★★★☆

| 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 Q1 only |

|

|---|---|---|---|---|---|---|

| EPU (SGDcents) | 6.04 | 4.95 | 5.47 | 7.16 | 11.33 | 1.01 |

| Change | 26% | -18% | 11% | 31% | 58% | 15% |

| P/E | P/E Industry |

P/B | P/CF | Equity Ratio |

ROE | Debt/ Equity |

Div YLD |

|---|---|---|---|---|---|---|---|

| 9 | 28 | 1.7 | 8.8 | 44% | 18% | 68% | 5.12% |