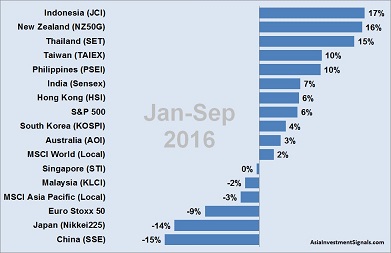

Our regular snapshot of APAC Market Performance ranking confirms our expectations from earlier this year (see our blog post: First Quarter Performance of APAC Markets – Visible Trends)

Our regular snapshot of APAC Market Performance ranking confirms our expectations from earlier this year (see our blog post: First Quarter Performance of APAC Markets – Visible Trends)

Indonesia, New Zealand, Thailand, Taiwan and Philippines with an increase of 10% and more remained on top of the performing markets in Asia. These four countries lead the performance ranking already seen after the first and second quarter of this year. Indonesia is the top performer in the region this year due to lower inflation and interest rates, and a government that is supportive of its industry. New Zealand had the second best performing market in Asia Pacific. Despite a strong currency, the country has a robust domestic consumption and a monetary policy that supports further economic growth.

On the lower end of the performance ranking is China and Japan which have lost 15% and 14% respectively since the beginning of this year. China has made up some ground from its bumpy start in January. Fears of a hard landing were overblown and the world gets slowly used to lower growth rate in China. Nevertheless, the risks derived from a credit-fueled growth and a lack of reforms is still present. Japan’s market has continued to shrink as the economy is hardly growing and the strong yen is hurting exports.

In the middle field of the performance ranking South Korea, Australia, Singapore, and Malaysia with performances from plus 4% to minus 2% without much change since earlier this year.

A surprise for us the performance of Hong Kong and India. Both markets showed a nice turnaround and rallied from their lows at minus 16% and minus 12% in February to a plus of 6% and 7% respectively. Hong Kong’s property market has bounced strongly back from its low in January and India has still a strong economic recovery outlook despite reforms that are progressing only slowly.

We don’t expect many surprises for the remaining three months of this year. Despite uncertainties with the outcome of the US election, stock markets tend to perform well towards the end of a year. This could bring another 2-3% performance for the already top running markets in Asia Pacific.