Raffles Medical Group (R01.SI) is Singapore’s largest private healthcare provider. Founded 1976, the Group operates hospitals, clinics, specialist centers in Singapore, Hong Kong, Shanghai and Osaka as well as representative offices in other neighboring countries. Due to the high standards of services and the strong branding Raffles Medical Group (RMG) is also benefiting from increased health tourism to Singapore.

Raffles Medical Group (R01.SI) is Singapore’s largest private healthcare provider. Founded 1976, the Group operates hospitals, clinics, specialist centers in Singapore, Hong Kong, Shanghai and Osaka as well as representative offices in other neighboring countries. Due to the high standards of services and the strong branding Raffles Medical Group (RMG) is also benefiting from increased health tourism to Singapore.

With a recent joint venture with International SOS (MC Holdings) RMG aims for further expansion in the region and an increase of its share of sales abroad from currently 10% to over 50%. The ten clinics in three countries (six in China, three in Vietnam and one in Cambodia) in this JV will soon be operated and branded under Raffles Medical Group and will support the existing network and planned expansion into the region. Another new 128.9m USD joint venture hospital project at Shanghai’s Bund which will serve China’s growing middle class and income elite is just to be completed by 2018.

This expansion strategy comes with an increase of depreciation and operating costs as well as costs for new installations which has put some pressure on the profits recently. But RMG is investing heavily in its future. Strong demand for reliable and high quality healthcare will continue to boost RMG’s growth around Asia.

Last year the group reported revenues of 375m SGD and a healthy profit of 68m SGD. Revenues continued growing another 7% in its latest financial results. RMG shows also a continued strong operating cashflow generated from its business operations with a healthy cash position of 89.5m SGD. Despite economic uncertainties in the Asian region we see RMG well positioned.

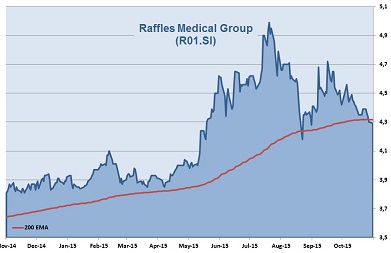

At its peak, the share price rose this year by almost 30% to 4.99 SGD. Since July, the stock could not escape the general market turbulences and came down to 4.30 SGD. A P/E of currently 35 times earnings seems a bit high with revenues and profits growing at a rate of 10-14%. 5 out of 12 analysts recommend the stock to buy. We want to capitalize on RMG’s perspectives and open a position of 4,000 shares at close today. If the 200 MA holds as support we see good chances to reach old highs by early next year.

Asia Investment Signals’ Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015e | 2016e | |

|---|---|---|---|---|---|---|

| EPS | 9.4 | 10.4 | 11.6 | 11.9 | 13 | 14 |

| Change | 10% | 11% | 11% | 3% | 9% | 8% |

| P/E: P/E Industry: |

35 28 |