Bloomage BioTechnology Corp. Ltd. (0963.HK) is an investment holding company and the world’s largest hyaluronic acid (referred to as “HA”) raw material manufacturer. Based in China and listed in Hong Kong since 2008 Bloomage products are primarily sold to Asia and the Americas.

Bloomage BioTechnology Corp. Ltd. (0963.HK) is an investment holding company and the world’s largest hyaluronic acid (referred to as “HA”) raw material manufacturer. Based in China and listed in Hong Kong since 2008 Bloomage products are primarily sold to Asia and the Americas.

The company develops, manufactures and distributes more than 70 hyaluronic acid (HA) raw material products used in pharmaceutical, cosmetic, and food industry. Bloomage also develops, manufactures and distributes HA-based end products under several brand names for medical skin care, ophthalmologic and intra-articular bone products which involve cosmetics, pharmaceuticals and other aspects of daily lives. In this business field, the company is China’s leading HA fillers and HA medical skin care product manufacturer.

Hyaluronic acid is a natural substance found in the human body. Although abundantly present in various body parts, its concentration gradually decreases with the age of a person. Through its hydrating, lubricating, viscoelastic, pseudoplastic, biodegradable and biocompatible benefits HA is gaining popularity as raw material and excipient in the pharmaceutical, cosmetic and healthcare products as an important compound in maintaining vital functions in the body. Various clinical studies indicate the effect of HA in skin healing and in the reduction of the appearance of scars. The moisture retention ability of hyaluronic acid makes it beneficial in the treatment of a variety of health conditions.

Together with Shanghai Haohai, Bloomage is a leading supplier of China’s cosmetic surgery business. The China Association of Plastics and Aesthetics (CAPA) reports more than 7 million people were having cosmetic surgery in 2014, mostly young women. China’s cosmetic surgery industry is valued at 61.4bn USD and is expected to double by 2019, making it the third largest market in the world.

After a strategic cooperation with the South Korean BioTech Company Medytox to develop and promote the Botulinum Toxin business in China and Korea, Singapore’s Government Investment Corporation (GIC) went aboard of Bloomage with an 85m USD investment.

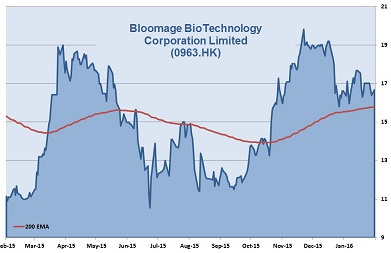

The company is currently priced 27 times its earnings, just lightly higher than the industry average, and around 42 times its book value, about double the industry average. The gearing ratio of 31 is around the industry average. HSBC and Barron’s recently rated Bloomage as a buy with a target price at last years high of 20 HKD a share. Currently priced at 16.70 HKD and with a rising 200 EMA as a support we also see this target price within a six months period.

AIS Rating: ★★☆☆☆

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|

| EPS | 0.19 | 0.233 | 0.285 | 0.282 | 0.473 | 0.553 |

| Change | 23% | 22% | -1% | 68% | 17% | |

| P/E: P/E Industry: P/B: Debt/Equity: |

19 25 3 71% |

(Rating and Table Updated: Jun 2016)