Techtronic Industries Co. Ltd. (0669.HK) is the world’s third largest producer of power tools and electrical home appliances behind Black & Decker and Bosch. Techtronic Industries (TTI) started in the 80’s as a contract manufacturer of batteries and battery-powered equipment for some of the cheapest trademarks of major US retail chains (Sears, Roebuck) but acquired over the years additional rights on various well-renowned brands such as AEG, Hoover, Ryobi, Dirt Devil. TTI’s well-known Milwaukee brand grew 24.4% globally.

Techtronic Industries Co. Ltd. (0669.HK) is the world’s third largest producer of power tools and electrical home appliances behind Black & Decker and Bosch. Techtronic Industries (TTI) started in the 80’s as a contract manufacturer of batteries and battery-powered equipment for some of the cheapest trademarks of major US retail chains (Sears, Roebuck) but acquired over the years additional rights on various well-renowned brands such as AEG, Hoover, Ryobi, Dirt Devil. TTI’s well-known Milwaukee brand grew 24.4% globally.

The Chinese group of companies with headquarters in Hong Kong and production facilities in the Pearl River Delta has today a staff of over 20,000 worldwide. In 2014 the group reported a profit of 300m USD derived from a turnover of 4,8bn USD. The first half year 2015 shows another impressive financial result with sales and profits up 10% and 16.5% respectively. Especially ongoing strategic investment in R&D to create break-through technology, expansion in its lithium cordless platforms and the delivering of broad-based end-user focused product have improved gross profit margin for the seventh consecutive year to now 35.6%. Only the EMEA region and TTI’s floor care products remain behind expectations due to a mandated Energy Labeling Directive in the EU and the strategic exit of its low margin OEM businesses. TTI sees it as short term effects with business resuming back to its normal course soon.

TTI, founded and managed by a German, has a company-wide commitment to innovation and strong customer partnerships, which consistently deliver new products that enhance customer satisfaction and productivity. TTI disciplined focus on four key strategic drivers of powerful brands, innovative products, exceptional people, and operational excellence allows the group to deliver consistently outstanding results across its business units and geographic regions. The company is at the forefront of the shift to lithium cordless products in the industrial and consumer tool, outdoor products and floor care segments.

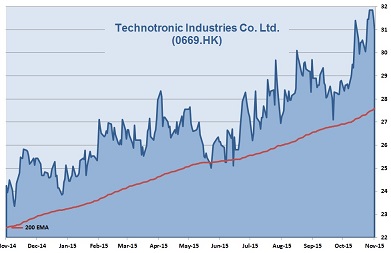

I would expect a better dividend than the 4.05 US cents paid for 2014, yielding only 1.1% which is not great. But the company comes with sound financial figures. Since 2008 the value of the stock grew steadily and gained more than 2000%. The company is valued currently at 23 times its earnings. Definitely a buy and hold stock.

Asia Investment Signals’ Rating: ★★★★☆

| 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|

| EPS | 6 | 9.5 | 11.4 | 13.7 | 16.4 |

| Change | 59% | 21% | 20% | 20% | |

| P/E current: P/E Industry: |

23 20 |