ASIA INVESTMENT SIGNALS is an information platform for investment opportunities across Asia Pacific. On a regular basis, we are discussing undervalued companies, hidden champions, and trending stocks. Our most promising investment ideas are tracked in our AIS Model Portfolio. Whether you are a private or an institutional investor, our research and analysis will help you to find the best investments in these promising markets. Sign up and follow our recommendations on Asia’s best stocks to invest right now!

Our Top 5 Recommendations

| TAIWAN SEMICONDUCTOR MFG CO LTD (2330.TW) | 486% |

|---|---|

| BYD COMPANY LTD (1211.HK) | 462% |

| TECHTRONIC INDUSTRIES COMPANY LTD (0669.HK) | 268% |

| FAST RETAILING CO LTD (9983.T) | 205% |

| TENCENT HOLDINGS LTD (0700.HK) | 186% |

Our AIS Model Portfolio is up 52% since inception … READ MORE

APAC Markets: First Trends in 2024

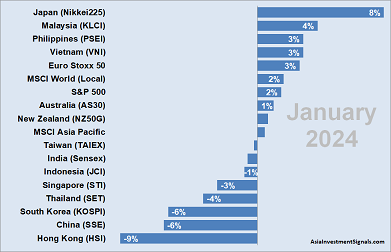

Last year’s high flyer Japan led the list of the best-performing markets in Asia-Pacific in January. Our regular ranking of the stock markets in Asia-Pacific in January shows possible trends over the next few months. Continue reading “APAC Markets: First Trends in 2024”

Last year’s high flyer Japan led the list of the best-performing markets in Asia-Pacific in January. Our regular ranking of the stock markets in Asia-Pacific in January shows possible trends over the next few months. Continue reading “APAC Markets: First Trends in 2024”

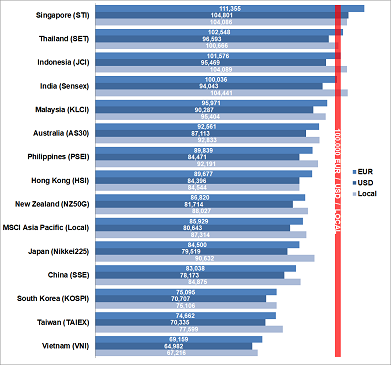

What a 100K Investment in Asia-Pacific Returned in H1 2023

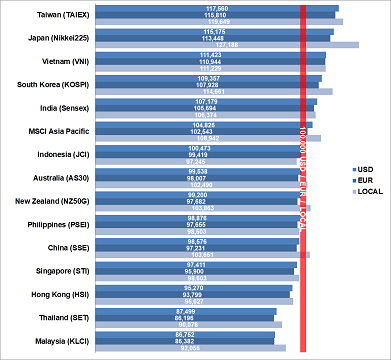

A quick recap of the stock market performances in Asia Pacific over the first half year of 2023 (as of 30th June 2023). What would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for the US Dollar, EUR, and local investors over the first half 2023. Continue reading “What a 100K Investment in Asia-Pacific Returned in H1 2023”

A quick recap of the stock market performances in Asia Pacific over the first half year of 2023 (as of 30th June 2023). What would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for the US Dollar, EUR, and local investors over the first half 2023. Continue reading “What a 100K Investment in Asia-Pacific Returned in H1 2023”

APAC Markets: First Quarter Performances 2023

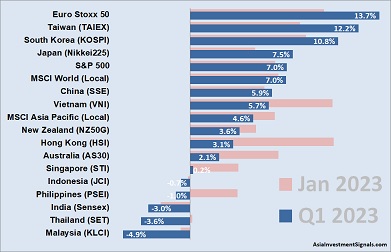

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter of 2023.

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter of 2023.

Taiwan and South Korea lead the list of APAC’s top performers over the first quarter. Not surprisingly, Taiwan and South Korea were among the worst APAC markets in 2022, with losses of 22 and 25 percent, respectively. Continue reading “APAC Markets: First Quarter Performances 2023”

SEA – A Turnaround With Many Risks

SEA Limited (SE) is a leading global consumer internet company founded in Singapore. SEA was initially founded as Garena Interactive Holding Limited – until now a leading global online games developer and publisher company known for its ‘Free Fire’ blockbuster game – before it changed its name to SEA Limited in 2017. The company operates primarily in Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia, and Singapore. Continue reading “SEA – A Turnaround With Many Risks”

SEA Limited (SE) is a leading global consumer internet company founded in Singapore. SEA was initially founded as Garena Interactive Holding Limited – until now a leading global online games developer and publisher company known for its ‘Free Fire’ blockbuster game – before it changed its name to SEA Limited in 2017. The company operates primarily in Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia, and Singapore. Continue reading “SEA – A Turnaround With Many Risks”

APAC Markets: First Trends in 2023

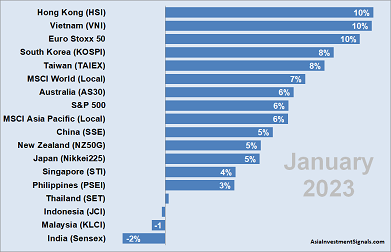

Many equity markets in the Asia-Pacific region started the year with great euphoria. A look at the stock market development in January can provide information about how the first trends could continue in the upcoming months. Continue reading “APAC Markets: First Trends in 2023”

Many equity markets in the Asia-Pacific region started the year with great euphoria. A look at the stock market development in January can provide information about how the first trends could continue in the upcoming months. Continue reading “APAC Markets: First Trends in 2023”

What a 100K Investment in Asia-Pacific Returned in 2022

An escalating war between Russia and Ukraine, rising energy prices, soaring inflation, climbing interest rates, a pandemic out of control in China, disruption in global supply chains, and intensifying geopolitical tensions between China and Taiwan. These have been the worries of investors in 2022.

An escalating war between Russia and Ukraine, rising energy prices, soaring inflation, climbing interest rates, a pandemic out of control in China, disruption in global supply chains, and intensifying geopolitical tensions between China and Taiwan. These have been the worries of investors in 2022.

Looking back on the stock markets in 2022, what would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for a US Dollar, a EUR, and a local investor over the last year. Continue reading “What a 100K Investment in Asia-Pacific Returned in 2022”