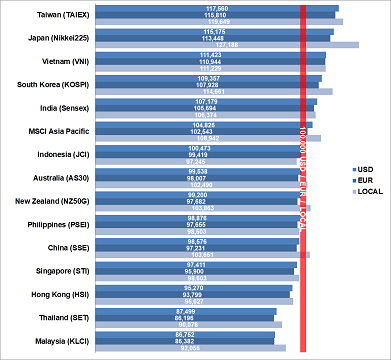

A quick recap of the stock market performances in Asia Pacific over the first half year of 2023 (as of 30th June 2023). What would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for the US Dollar, EUR, and local investors over the first half 2023.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

A quick recap of the stock market performances in Asia Pacific over the first half year of 2023 (as of 30th June 2023). What would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for the US Dollar, EUR, and local investors over the first half 2023.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Overall, the Asia-Pacific stock markets increased by 9 percent for the local-, 5 percent for the USD-, and 3 percent for the EUR-investor over the first half year of 2023 when measured with the MSCI Asia-Pacific Index. 8 out of 14 APAC markets we track returned between 2 and 27 percent, while six markets ended the first half year with losses up to 10 percent for a local investor.

The highest return of 27 percent would have made a local investor with Japanese stocks over the first half year of 2023. A EUR-based investor would have experienced the most significant loss of 14 percent with Malaysian and Thailand stocks over that period.

Japan, Taiwan, and Vietnam produced double-digit returns between 11 and 27 percent for all three investors – the US Dollar, the EUR, and the local investors. And only Malaysian stocks ended the first half-year with double-digit losses for all three investors.

Looking only at the second quarter of 2023, Indian and Japanese stocks showed the highest momentum with gains of 10 and 18 percent, respectively, while Thailand and Hong Kong stocks lost 7 percent.

Many geopolitical and economic developments are currently difficult to assess: the further course of the war in Ukraine, the medium-term effects of inflation, especially in the industrialized countries, and the further decisions of the central banks on interest rate developments, a weakening economy in China, among other things due to increasing tensions between China and Western countries, especially the USA. The second half of the year remains a challenge for every investor.

[/mepr-active]