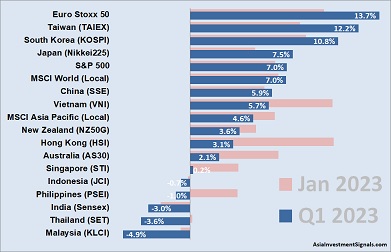

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter of 2023.

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter of 2023.

Taiwan and South Korea lead the list of APAC’s top performers over the first quarter. Not surprisingly, Taiwan and South Korea were among the worst APAC markets in 2022, with losses of 22 and 25 percent, respectively.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Both markets showed already an above-average return at the beginning of this year, finishing January as second best. Taiwan and South Korea followed this trend over the next two consecutive months and returned 12.2 and 10.8 percent, respectively, by the end of the first quarter.

Malaysia, Thailand, and India are on the lower end of our APAC ranking. Malaysia and India were the only APAC markets with a negative return in January. Malaysia dropped another four percent over the next two months and lost almost 5 percent by the end of the first quarter. India, which has been among the top-performing APAC markets in 2022 with 4 percent, ended the month of January with a negative return of 2 percent and continued to decline with a loss of 3 percent by the end of the first quarter. Thailand started in January unchanged but fell over the following two months, ending with a loss of almost 4 percent by the end of the first quarter.

We added the January performances (light red) into the graph to show where the smart money has flowed over the past two months. There have been more declines than advances over those previous two months. Only Taiwan, South Korea, and Japan increased between 2 and 4 percent. In contrast, seven APAC countries dropped between 3 and 7 percent in February and March.

Notably also: After the desolate year 2022, Vietnam and Hong Kong were among the top performers in January but lost 4.2 and 6.6 percent, respectively, over the following two months.

The S&P 500 and the Euro Stoxx 50 gained 7 and 13.7 percent, respectively. This year, the MSCI World gained 7 percent, while the MSCI Asia Pacific index advanced by 4.6 percent.

War in Ukraine, geopolitical tensions in Asia and Africa, and ongoing high inflation worldwide, which leads to rising interest rates, are still the main points of concern at present. Measured by the MSCI World, the markets have still to climb another 13 percent to reach the old highs from January 2022. The stock market will likely continue climbing along a wall of worries and remain volatile. The situation might calm down towards the end of the year, which, as is often the case, ends in a year-end rally. Well, let’s see.

[/mepr-active]