An escalating war between Russia and Ukraine, rising energy prices, soaring inflation, climbing interest rates, a pandemic out of control in China, disruption in global supply chains, and intensifying geopolitical tensions between China and Taiwan. These have been the worries of investors in 2022.

An escalating war between Russia and Ukraine, rising energy prices, soaring inflation, climbing interest rates, a pandemic out of control in China, disruption in global supply chains, and intensifying geopolitical tensions between China and Taiwan. These have been the worries of investors in 2022.

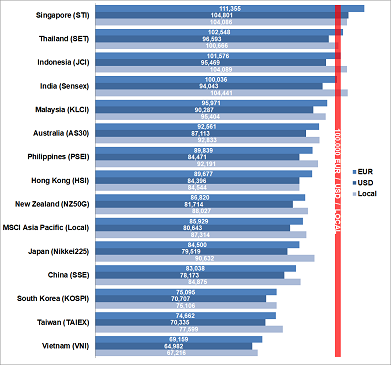

Looking back on the stock markets in 2022, what would have an investment of 100K in USD, EUR, or local currency returned to an investor in Asia-Pacific? Our regular ranking shows the return for a US Dollar, a EUR, and a local investor over the last year.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Overall, the Asia-Pacific stock markets declined 13 percent in 2022 when measured with the MSCI Asia-Pacific Index on a local basis. But this is not the complete picture. Only 4 out of 14 APAC markets we track produced decent returns for a local investor. Six markets ended the year with double-digit losses.

The highest return of 11 percent would have made a EUR investor with Singapore stocks in 2022. A US Dollar investor would have experienced the most significant loss of 35 percent with Vietnamese shares last year.

The year 2022 was particularly unfavorable for a US Dollar investor due to the strengthening of the US Dollar against most other currencies. The USD Index, a measure of the value of the US Dollar relative to a basket of six major foreign currencies, gained more than 8 percent over 2022. Three Asia-Pacific currencies – Taiwan, India, and Japan – lost even between 10 and 14 percent against the US Dollar.

The South Korean, Taiwanese, and Vietnamese markets produced losses between 25 and 35 percent for all three investors – the US Dollar, the EUR, and the local investor – and ended at the bottom of our APAC ranking list.

Singapore has been the best market in Asia-Pacific in 2022, producing profits between 4 and 11 percent for all three investors.

Looking only at the last quarter of 2022, the Hong Kong and Philippines stock market showed the best momentum over that last quarter. Both markets caught up 14 and 15 percent over this period, a rate that could also continue in 2023.

See also: What a 100K Investment in Asia-Pacific Returned in H1 2022

[/mepr-active]