Three months are left until this year ends. Time for our quarterly snapshot of Asia-Pacific’s stock markets for the remaining period. October is statistically the month with the highest volatility in the year. November and December are often two well-performing months due to the tendency for a year-end rally. However, many market participants are waiting for a cleansing and final sell-off in this bear market.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Three months are left until this year ends. Time for our quarterly snapshot of Asia-Pacific’s stock markets for the remaining period. October is statistically the month with the highest volatility in the year. November and December are often two well-performing months due to the tendency for a year-end rally. However, many market participants are waiting for a cleansing and final sell-off in this bear market.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

The markets have not capitulated yet, which could herald a turnaround. The year-end rally is statistically likely, but not a sure bet. Uncertainty about the further course of the Ukraine war, inflation rates that are still too high, fears of a recession, and many other geopolitical risks continue to weigh on the global economy. We, therefore, expect markets to continue falling as long as not all risks are on the table and priced in.

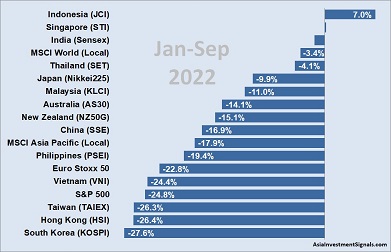

Looking back on this year, our stock market performance ranking shows that most Asia-Pacific markets have produced negative returns over the first nine months of this year. Nine out of 14 Asian markets we follow showed double-digit losses, with Taiwan, Hong Kong, and South Korea as the worst markets this year.

Only two APAC markets showed gains this year, with Indonesia heading the list of best-performing markets with a return of 7 percent.

However, the strongest increase over the last three months showed India with a gain of 8 percent, followed by Indonesia (2 percent) and New Zealand (2 percent). On the other hand, China lost 11 percent, and Hong Kong lost even a whopping 21 percent over the third quarter.

The MSCI Asia-Pacific Index lost almost 18 percent on a local currency base and more than 28 percent on a USD base this year. We also included the MSCI World, the S&P 500, and the EURO STOXX 50 Index for comparison in our ranking.

[/mepr-active]