JinkoSolar Holding Co. Ltd (JKS) is the world’s largest solar module manufacturer by module shipments. The company has recently been named one of the 50 smartest and most innovative firms in China by MIT Technology Review and by Forbes for its outstanding and continuous innovation and achievements in solar technology with the ability to benefit from the entire value chain.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] JinkoSolar has been the first to deliver 100 GW of modules. The company’s annual capacity lies at 43 GW for mono wafers, 42 GW for solar cells, and 50 GW for solar modules. With 14 global production sites and 21 overseas subsidiaries, JinkoSolar sells its products to utility, commercial, and residential customers. Due to its large-scale operations, the company has gained a global market share of 15 percent.

JinkoSolar Holding Co. Ltd (JKS) is the world’s largest solar module manufacturer by module shipments. The company has recently been named one of the 50 smartest and most innovative firms in China by MIT Technology Review and by Forbes for its outstanding and continuous innovation and achievements in solar technology with the ability to benefit from the entire value chain.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] JinkoSolar has been the first to deliver 100 GW of modules. The company’s annual capacity lies at 43 GW for mono wafers, 42 GW for solar cells, and 50 GW for solar modules. With 14 global production sites and 21 overseas subsidiaries, JinkoSolar sells its products to utility, commercial, and residential customers. Due to its large-scale operations, the company has gained a global market share of 15 percent.

Asia Pacific, including China, is JinkoSolar’s most important geographic market, accounting for half of the sales. Europe accounts for 18 percent of the sales, followed by North America with 16 percent.

JinkoSolar started as a wafer manufacturer in 2006 and has been listed on the New York Stock Exchange since 2010. The company is headquartered in Shangrao, China. Its shares can also be traded in Germany, the UK, Mexico, and Austria. As of December 2021, the three active founders of the company, Xiande Li, chairman and CEO, as well as Kangping Chen and Xianhua Li, both directors, own about 20 percent of the outstanding ordinary shares. Around 94 percent of the shares are in public hands.

With a workforce of over 31 thousand employees, JinkoSolar reported revenues of 33.6bn RMB (5bn USD) and a loss before tax of 59m RMB (8.9m USD) over the first half year of 2022. Revenues increased by 112 percent compared to the same period a year ago. For the full fiscal year 2021, revenues and profits increased by 16 and 92 percent, respectively. The increase was mainly due to higher sales volume, attributable to China’s favorable renewable energy policies and the increase in global demand. The operating margin of roughly four percent is nevertheless well below its industry peers. Higher sales volumes only partially offset the declining average selling price of solar modules as a result of intensifying global competition. Increasing raw material costs also put pressure on the operating margins. JinkoSolar’s cash reserves increased by 60 percent to 13.3bn RMB (1.9bn USD), while debts and lease obligations increased by 2 percent to 25.7bn RMB (3.8bn USD) over the first half year of 2022.

The company shows an acceptable balance sheet with satisfactory profitability but only poor financial strength. The equity ratio is at 24 percent and the gearing, defined here as total liabilities to total equity, is at a poor 318 percent. Moody’s daily credit risk score for JinkoSolar is 9, indicating a high risk based on the day-to-day movements in market value compared to the company’s liability structure. Next earning results will be announced at the end of November.

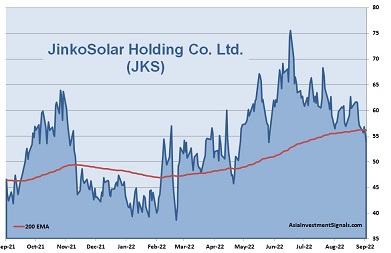

JinkoSolar’s shares have been in an uptrend since June 2020 and gained about 180 percent in value since, a 17 percent increase alone this year. The company is currently priced at 1.2 times book value and 41 times operating cash flow. JinkoSolar does not pay dividends. Four out of seven analysts currently have a ‘buy’ or ‘outperform’ recommendation on the stock, with an average target price of about 65 USD.

Our conclusion: JinkoSolar is a company to keep on the watchlist but currently comes only with weak financial positions, just satisfactory profitability, and poor financial strength. The valuation based on a forward PE of 9 is reasonable and comes with a compounded annual growth rate for revenue and profits of 4 and 9 percent, respectively, over the last five years.

The outlook for the renewable energy industry remains positive. Solar power is the fastest growing renewable energy, representing over half of the 302 GW of renewable capacity installed internationally in 2021. The global solar market is growing exponentially. It took around a decade to increase the worldwide solar power capacity from 100 GW to 1 TW in 2022. According to SolarPower Europe, the capacity will more than double to 2.3 TW within the next three years only.

JinkoSolar continues to hold a considerable share in this market. The company’s share buyback program could push future stock returns, supported by the fact that the company is undervalued on a price-sales basis. The growing demand for solar energy and the company’s solid market share supports the company’s positive outlook. JinkoSolar is well positioned in a strong competitive environment. Operation margins are slowly expanding again and should lead to better company profitability over time. Assuming a stabilizing global economy, we expect the share price to increase 5 to 10 percent over the next six months.

AIS Rating: ★★★☆☆

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 H1 only |

|

|---|---|---|---|---|---|---|

| EPS (RMB) | 4.3 | 10.5 | 19.4 | (5.4) | 8.0 | (12.2) |

| Change (%) | (86) | 144 | 84 | (128) | (248) | (379) |

| DPS (RMB) | n/a | n/a | n/a | n/a | n/a | n/a |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| At Loss | 34 | 1.2 | 41 | 24 | -1.1 | 318 | n/a |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]