HKT Trust and HKT Limited (6823.HK) is Hong Kong’s premier telecommunications service provider and a leading operator in fixed-line, broadband and mobile communication services. HKT Trust and HKT Limited (HKT) is furthermore active in Greater China, Asia, Europe, the Middle East, Africa and the Americas. Its international telecommunications network covers more than 3,000 cities and 140 countries.

HKT Trust and HKT Limited (6823.HK) is Hong Kong’s premier telecommunications service provider and a leading operator in fixed-line, broadband and mobile communication services. HKT Trust and HKT Limited (HKT) is furthermore active in Greater China, Asia, Europe, the Middle East, Africa and the Americas. Its international telecommunications network covers more than 3,000 cities and 140 countries.

Once the largest telecommunications company in the former British Colony, HKT is today a listed unit of Richard Li’s, the younger son of tycoon Li Ka-Shing, Pacific Century Cyberworks (PCCW) since 2000.

The Company operates in three segments: telecommunications services, mobile and other businesses such as network integration and related services to telecommunications operators.

HKT has become the largest mobile service operator in Hong Kong, serving mobile communications needs under the three acquired brands: 1O1O, csl. and SUN Mobile. HKT holds furthermore a dominant position in fixed-line, IDD and broadband services in Hong Kong. The expansion of its fiber network services and newly launched payment services, which enables customers to make mobile payments at more than three million retail terminals in Hong Kong and overseas, are major developments for future growth opportunities and for enhanced service plans.

Despite a slow local economic growth and a weaker retail and consumer market, HKT reported in 2015 a steady performance across all business lines. With a staff of around 19,400 and revenues of 4,452m USD HKT generated an EBITDA of 1,551m USD, an increase of 18% compared to a year ago. This results in a profit margin of 35%.

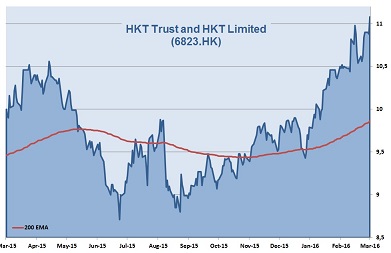

12 out of 15 covering analysts rate the stock with outperform or buy. The share is in an uptrend since 2013 and has hardly been affected by the bearish sentiments beginning of this year. Having overcome a major resistance of old highs at 10.60 HKD, the share should have an upside potential of at least 15% in the next six to twelve months. We are going to enter a position at close today.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016E | |

|---|---|---|---|---|---|---|

| EPS | 26.8 | 25.1 | 36.8 | 42.2 | 52.2 | 58 |

| Change | -7% | 47% | 15% | 24% | 11% | |

| P/E: P/E Industry: P/B: Debt/Equity: |

21 22 2.2 97 |