Airports of Thailand Public Company Limited (AOT.BK) is Thailand’s largest airport operation company. Its 6 international airports (Suvarnabhumi Airport, Don Mueang Airport, Chiang Mai, Hat Yai, Phuket, Mae Fah Luang-Chiang Rai) accounts for 86% of Thailand’s passenger traffics. AOT is furthermore involved in the hotel and restaurant business as well as rental of offices and real estate properties. The company was founded in 1903 and is headquartered in Bangkok. Since March 2004 listed on the SET, the shares can also be traded in the US and in Germany.

Airports of Thailand Public Company Limited (AOT.BK) is Thailand’s largest airport operation company. Its 6 international airports (Suvarnabhumi Airport, Don Mueang Airport, Chiang Mai, Hat Yai, Phuket, Mae Fah Luang-Chiang Rai) accounts for 86% of Thailand’s passenger traffics. AOT is furthermore involved in the hotel and restaurant business as well as rental of offices and real estate properties. The company was founded in 1903 and is headquartered in Bangkok. Since March 2004 listed on the SET, the shares can also be traded in the US and in Germany.

In 2015 the total number of passengers increased by 22% to 107 million, the total number of flights increased by 16% to 707 thousand on AOT’s six airports. Thailand’s popularity as a tourist destination remains unbroken with double digit growths figures since 2010, with exception of the year 2014. And passenger arrivals continued to increase in the first quarter of 2016 by 15.45% compared to same period 2015. If this trend continues, about 34-35 million tourists are expected to arrive in 2016.

Several extension and enhancement projects are under way taking account of the growing trend in air transportation, the low-cost airline segment expansion, the growing purchasing power among foreign visitors and the integration of ASEAN Economic Community. AOT’s largest project is currently the increase of the Suvarnabhumi Airport’s capacity from 45 to 60 million passengers per year. This 62bn THB project, which shall be completed by 2019, will significantly reduce the congestion of passengers and increased number of flights. A new terminal at Phuket International Airport is expected to begin operations on June 2016, which will almost double the number of passengers it can handle to 12.5m people.

Thailand’s Ministry of Finance owns 70% of the company. This gives AOT a state enterprise status with effects on some of its transactions and business activities such as special power rules to speed up approvals for major investment projects.

With a staff of 6,044 and revenues of 43,969m THB AOT generated a net profit of 18,729m THB in 2015, a lush profit margin of 43%. The increase in profits of 53% comes after a difficult year 2014 where Thailand’s travel industry was hit by the military coup and demonstrations. Dividend per share and earnings per share growth ranked among the highest in its industry peers. AOT comes with an ROE of over 18%, much above industry average, and a sound debt-to-capital ratio of 22%. Foreign loans are borrowed in Japanese yen and guaranteed by the Ministry of Finance (Thailand’s credit rating: BBB+ stable). Foreign exchange risks are hedged with cross currency swaps for most of the loans received in Japanese yen.

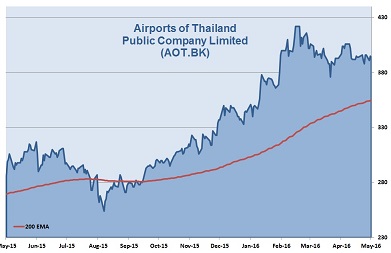

The majority (11 out of 24) of covering analysts recommend the stock currently as hold only. We like the solid fundamentals of AOT and the outlook of further growth in the number of passengers arriving in Thailand. Nevertheless risk of higher oil prices might slow down this trend. The share is currently priced at 28 times its earnings, definitely not cheap. After a strong trend the stock is consolidating since March. This is partly due to the beginning of the low season for Thailand’s tourism during April to September. We expect the stock to resume trending toward the second half of this year. The company is worth to be kept on the watchlist.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

| EPS (HKD) | 1.82 | 4.54 | 11.43 | 8.51 | 13.11 |

| Change | 73% | 149% | 152% | -26% | 54% |

| P/E | P/E Industry |

P/B | P/CF | Equity Ratio |

ROE | Debt/ Capital |

Div YLD |

|---|---|---|---|---|---|---|---|

| 29 | 10 | 5 | 22 | 70% | 18% | 22% | 1.7% |