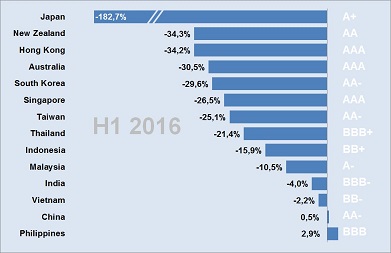

After an overview of the government bond markets in Asia Pacific in our posting from June (The Government Bond Market in APAC) we have drawn a snapshot of the changes in yields of 10-year government bonds during the first six months of 2016.

After an overview of the government bond markets in Asia Pacific in our posting from June (The Government Bond Market in APAC) we have drawn a snapshot of the changes in yields of 10-year government bonds during the first six months of 2016.

A drop in yields is caused by a higher demand for bonds. Reasons to buy bonds are on the one hand falling interest rates, which makes higher yielding bonds more lucrative, but can also be interpreted as a sign of risk aversion of investors on the other hand. Investors are shifting money from the riskier equity market to the safer bond market as they see fewer opportunities in the stocks market. But we have also markets around Asia Pacific where both stocks and bonds have developed in the same direction.

Japan’s yield for 10-years government bonds have dropped from 0.27% to -0.23% in the first half year, a change of minus 182%. Negative interest rates of -1%, a modest outlook for equities and a deflationary economy (inflation rate at -0.4%) have caused investors to seek the safe haven of A+ rated government bonds and have massively shifted money out of the equity. Japan’s stock market has lost 18% during that same period.

Hong Kong’s yield for 10-years government bonds have dropped from 1.59% to 1.05%, a minus of 34%. Hong Kong’s interest rates have been remained stable this year at 0.75%. Inflation is at 2.4%. The country is rated AAA from S&P with a negative outlook. Hong Kong’s good rating and an uncertain outlook of China’s economy have caused investors to seek safety in the bond market. Hong Kong’s stock market has lost 5% during that same period.

Philippine on the bottom of the scale has yields for government bond that have risen from 4.1% to 4.22% during the first six months of this year, a change of 2.9%. Philippine has an interest rate of 3% and a moderate inflation of 1.9%. The country is rated BBB by S&P with a stable outlook. Investors were more confident to put money in the equity market. Philippines stock market has gained 12% during that same period.

Indonesia’s government bond yields have dropped almost 16% to yields of around 7.5%. The bond market has still potential to increase. The countries BB+ rating is on a positive outlook and might be upgraded in the near future. Indonesia’s stock market has well advanced with 9% in the first half of this year, despite the strong headwind from unfavorable commodity prices from which the country’s export is depending.

New Zealand and Thailand are two countries in Asia Pacific where both the stock and the bond markets have risen strongly together. Yields for 10-years government bonds are down 34% and 21% while the stock markets are up 9% and 12% respectively in the first half of this year. Both countries have moderate but stable growing economies with low interest and inflation rates. Investors took advantage of a positive economy outlook as well as a relatively safe bond market with yields still at 2.4% and 2%.

Some conclusion can be drawn for the second half of this year. Countries with yields nearby or below zero have hardly room for a further increase in bond prices. This applies particularly for Japan with negative yields, for Taiwan with yields below 1% and for Hong Kong with yields of around 1%. The money will at some point flock back into the equity market. We believe that especially smaller undervalued companies will profit disproportionally in those countries with stagnating economies.