Avi-Tech Electronics Ltd (BKY.SI) provides burn-in services and manufacturing, printed circuit board assembly (“PCBA”) services, and engineering services for OEMs in the semiconductor, electronics, and life sciences industries. It also manufactures digital imaging systems for the life sciences industry. The company has a market presence in Asia, the US, and in Europe. Two of its customers account for around 40% of the company’s revenues.

Avi-Tech Electronics Ltd (BKY.SI) provides burn-in services and manufacturing, printed circuit board assembly (“PCBA”) services, and engineering services for OEMs in the semiconductor, electronics, and life sciences industries. It also manufactures digital imaging systems for the life sciences industry. The company has a market presence in Asia, the US, and in Europe. Two of its customers account for around 40% of the company’s revenues.

Avi-Tech Electronics was founded in 1981 and has its headquarter and production facility located in Singapore. The company is listed on the Mainboard of the Singapore Exchange since 2007. The free float of shares is around 65%. Avi-Tech Electronics’ shares can also be traded in Germany.

After three years of losses Avi-Tech Electronics came back to profitability in 2015 due to the recovery in the semiconductor industry and due to the disposal of two loss-making US subsidiaries. Avi-Tech Electronics has therefore been recently removed from the SGX-ST Watch-List, a quarterly review of companies that does not meet SGX listing criteria for a certain period.

The semiconductor industry is supposed to benefit from the ‘Internet of Things’ in the future, a market which is estimated to generate around 4 to 11 trillion USD worldwide by 2025. Especially microcontrollers, sensors, connectivity, and memory, are areas for increased demand for Avi-Tech Electronics’ burn-in services. Further areas of growth for the company are rising demand for electronic components in the automotive sector, including the steady progression towards self-driving vehicles, the growing networking devices industry, as well as the rising demand for energy efficient and secure data centers. These industries with increased demand for fail-safe devices will require high power burn-in services.

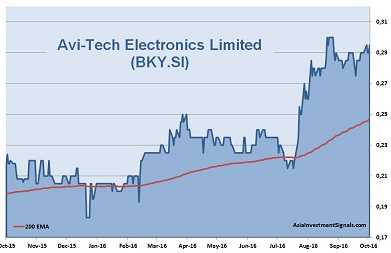

With a staff of 260 employees, Avi-Tech Electronics generated revenues of 33.9m SGD and a profit before tax of 7.9m SGD in its fiscal year ending June 2016. An increase of 19.5% and 103.1% respectively compared to the year before. Cash flow from operations increased 68.7% to 7.9m SGD. The company holds a cash and equivalent of 6.5m SGD. The balance sheet shows a robust equity ratio of 86% and a debt to equity ratio of 16%. The company is priced at only eight times earnings, well below industry average, and comes with a dividend yield of more than 6%. The shares are in an uptrend since October 2014 and gained 168% since. With the tailwind from a recovering global economy, we expect this positive momentum to continue at least for the next six months.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| EPS (RMB) | 0.62 | -4.76 | -2.2 | -5.8 | 3.82 | 3.63 |

| Change | -73% | -868% | 54% | -164% | 166% | -5% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 8 | 18 | 1.1 | 6.9 | 86% | 14% | 16% | 6.2% |

* Equity / Total Assets, ** Total Liabilities / Equity