SAIC Motor Corporation Limited (600104.SS) is China’s largest automaker and a key player in the automotive industry. SAIC Motor’s business covers R&D, manufacturing, and distribution of passenger and commercial vehicles as well as related parts and accessories. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Furthermore, SAIC provides electronic components, logistics, vehicle telematics, as well as second-hand vehicle transactions and auto financing services. The company is engaged in several key partnerships with western brands such as Volkswagen, General Motors, Iveco, and Volvo. Joint venture talks with German Audi are currently put on hold due to friction between car manufacturers and dealers. SAIC Motor’s vehicle sales expanded nearly 14% to 28.1m units in 2016, and with revenues of 107bn USD in 2015, the company ranks 46th on the Fortune Global 500 list.

SAIC Motor Corporation Limited (600104.SS) is China’s largest automaker and a key player in the automotive industry. SAIC Motor’s business covers R&D, manufacturing, and distribution of passenger and commercial vehicles as well as related parts and accessories. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Furthermore, SAIC provides electronic components, logistics, vehicle telematics, as well as second-hand vehicle transactions and auto financing services. The company is engaged in several key partnerships with western brands such as Volkswagen, General Motors, Iveco, and Volvo. Joint venture talks with German Audi are currently put on hold due to friction between car manufacturers and dealers. SAIC Motor’s vehicle sales expanded nearly 14% to 28.1m units in 2016, and with revenues of 107bn USD in 2015, the company ranks 46th on the Fortune Global 500 list.

SAIC Motor’s roots are reaching back to Mao’s China in the 1940s. The state-owned company was incorporated in 1984 with shares listed on the Shanghai Stock Exchange. Only 18% of the shares are traded publicly.

SAIC Motor accounts for roughly 25% of China’s auto market, the world’s largest car market. China’s automobile market grew by strong 15% in 2016 and sales are expected to continue growing by further 5% to 24.2 million units in 2017. Even the domestic automobile market starts to get gradually saturated; there is still enormous potential in the aftermarket and the application of crossover technologies. With the rebound of China’s economy, SAIC Motor’s market is huge. As a state-owned company, SAIC Motor also enjoys a certain stability that other competitors do not have.

The collaborations between Chinese carmakers and tech companies (Baidu, Huawei, Alibaba, and others) might become significant sales drivers in the future. At the Beijing Auto Show last April SAIC Motor presented over a hundred new models including an internet-connected SUV, built in partnership with Alibaba, and several new energy cars. The company is also planning timeshare rentals for new energy vehicles in its 4,000 outlets in over 20 cities and the installation of 50,000 public charging locations across the country.

With a workforce of around 164 thousand employees, SAIC Motor reported revenues of 532bn CNY (77.6bn USD) and a profit before tax of 37bn CNY (5.4bn USD) for the first nine months of 2016. An increase of 12% and 9% respectively compared to the same period a year ago. In 2015 revenues and profit were up 6.4% and 7.3% respectively. The company had cash and equivalents of 55bn CNY (8.1bn USD) by the end of September. The balance sheet looks a bit weak, but still acceptable for a state-owned company.

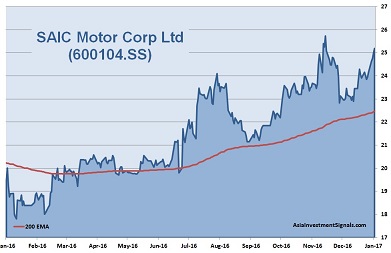

SAIC Motor’s shares are in an uptrend since September 2015 and gained nearly 80% since. The company is currently priced at only nine times earnings, well below its industry peers, and comes with a nice dividend yield of 5,5%. 16 out 24 covering analyst recommend the shares as outperformer or as a buy. SAIC Motor is a prolific innovator in China which might strongly benefit from new intelligent interconnection and new energy technologies in the automotive industry.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 Q1-3 Only |

|

|---|---|---|---|---|---|---|

| EPS (RMBcents) | 1.83 | 1.88 | 2.25 | 2.54 | 2.7 | 2.1 |

| Change | 14% | 3% | 20% | 13% | 6% | 9% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 9 | 27 | 1.5 | 12 | 34% | 18% | 196% | 5.5% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]