Mieco Chipboard Bhd (5001.KL) is a major player in the particle board industry. Particle boards, also known as chipboards, are made by using wood particles and rubber wood together. Particle boards are cheaper than conventional timber as well as denser and less expensive than plywood.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] With two factories located in Malaysia, the company sells its products to Asia and the Middle East. Malaysia contributes 74% to the total revenues.

Mieco Chipboard Bhd (5001.KL) is a major player in the particle board industry. Particle boards, also known as chipboards, are made by using wood particles and rubber wood together. Particle boards are cheaper than conventional timber as well as denser and less expensive than plywood.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] With two factories located in Malaysia, the company sells its products to Asia and the Middle East. Malaysia contributes 74% to the total revenues.

Mieco Chipboard was founded in 1972 and is headquartered in Kuala Lumpur, Malaysia. The company is listed on the main board of Kuala Lumpur’s Stock Exchange since 1998. 35% of the shares are in public hand, 57% owns the new group’s managing director, Mr. Dato’ Sri Ng Ah Chai, who is also a major shareholder of Mieco Chipboard’s competitor SYF Resources. Synergy effects and a possible consolidation with SYF Resources are therefore very likely in the near future.

Analysts predict an increasing demand for particle board due to a stronger USD and a shortage of raw material in China’s factories as a result of the strict logging imposed by the country since 2015. Recent floods in Thailand will also have an effect on the supply of raw materials. Prices for particle board are expected to increase over 10% this year.

With a workforce of 929 employees, Mieco Chipboard reported revenues of 324m MYR (73m USD) and profits before tax of 73m MYR (16m USD) for 2016. A decrease of 9% in revenues and increase of 289% in profits on a year-on-year basis. Without the recent disposal of a subsidiary and the write back of impairment on a plant, profits before tax decreased by almost 50% on a year-on-year basis. In 2015 revenues were up 10% while profits remained flat compared to the year before. Mieco Chipboard had cash reserves of 36m MYR (8m USD) at the end of 2016. The company shows a healthy balance sheet with an equity ratio of 67% and a low gearing.

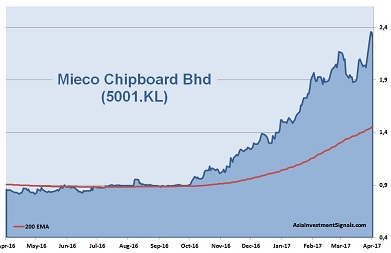

Mieco Chipboard’s shares are in an uptrend since December 2014 and more than quintupled in value since, and gained alone 167% in the last eight months. The company is still reasonably priced at only six times earnings, compared to 119 times among its sector peers. Mieco Chipboard trades just slightly above book value and at only five times cash flow. The last dividend yielded more than 4%.

Mieco Chipboard is heading in the right direction. Tailwind can be expected from a stronger demand and higher prices for particle board as well as from synergy and consolidation effects initiated by the new managing director and majority share owner. A further 20% share price increase should be possible until the end of this year.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| EPS (MYR) | 0,03 | -0,03 | -0,3 | 0,09 | 0,09 | 0,39 |

| Change | 200% | -200% | -900% | 130% | 0% | 343% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 6 | 120 | 1 | 5 | 67% | 25% | 49% | 4.4% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]