SPC Power Corporation (SPC.PS) is engaged in power generation and distribution to end-users. The company was originally incorporated as a venture under the name, Salcon Power Corporation, to operate and manage the 204 MW Naga Power Plant Complex on Cebu Island Philippines and to sell the electricity to the National Power Corporation, its sole customer, under a take-or-pay agreement.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company operates today a gas turbine power plant with 55MW as well as three diesel power plants with 146.5MW, 22MW, and 1.6MW.

SPC Power Corporation (SPC.PS) is engaged in power generation and distribution to end-users. The company was originally incorporated as a venture under the name, Salcon Power Corporation, to operate and manage the 204 MW Naga Power Plant Complex on Cebu Island Philippines and to sell the electricity to the National Power Corporation, its sole customer, under a take-or-pay agreement.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company operates today a gas turbine power plant with 55MW as well as three diesel power plants with 146.5MW, 22MW, and 1.6MW.

SPC Power has begun to seek new opportunities in renewable-energy projects including hydro, geothermal and biomass power plants. The company also pursues plans for coal-fired power projects and power barges and continues to focus on efficiency improvements and to leverage existing business.

SPC Power was founded in 1994 and is headquartered in Makati, Philippines. Its shares are listed on Philippines’ Stock Exchange since 2002. Around 80% of the shares are owned by KEPCO, Intrepid, and JAD. Only 8% of the shares are traded publicly.

Energy demand is expected to triple by 2040 in the Philippines. Despite a deregulated energy market, Philippines has struggled to attract investments to expand its energy infrastructure. The new government now reviews some of its previous policies to secure and diversify a supply mix over the longer term.

With a workforce of 290 employees, SPC Power reported revenues of 4.2bn PHP (84m USD) and a profit before tax of 1.9bn PHP (39m USD) for 2016, an increase of 4.8% and 18% respectively compared the year ago. In 2015, revenues and profits were both slightly down 0.2 % compared to the year before. The operating margin of 24% is average to its industry peers. SPC Power had cash reserves of 619m PHP (12m USD) at the end of 2016. The company shows a solid balance sheet with an equity ratio of 81% and a gearing, defined here as total liabilities to total equity, of just 24%.

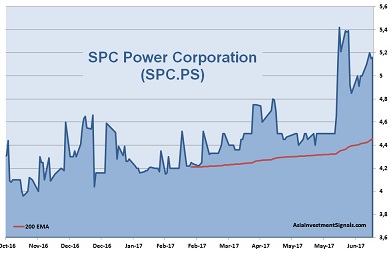

SPC Power’s shares are in an uptrend since November 2015 and gained 40% in value since, 12% alone this year. The company is currently priced at only five times earnings, compared to 13 times among its sector peers. The shares trade below book value and at four times cash flow only. The last dividend payment yielded almost 14%.

The Philippines is one of the top performing economies in Southeast Asia. New power plants will be needed to keep up with the rising demand. SPC Power will have its share of the market as the government is further deregulating the market. The company seems well managed with sound financials. The announcement to seek opportunities in renewable-energy projects has driven share prices up recently. We expect specific plans to come soon.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 Q1 only |

|

|---|---|---|---|---|---|---|---|

| EPS (PHP) | 0.28 | 0.66 | 0.52 | 0.89 | 0.99 | 1.16 | 0.35 |

| Change | 17% | 136% | -21% | 71% | 11% | 17% | -5.4% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 5 | 13 | 0.9 | 4 | 81% | 21% | 24% | 14% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]