Keong Hong Holdings Ltd (5TT.SI) is a Singapore based construction company and property developer. The company is furthermore engaged in joint property investments with partners and associates. Currently, around 90% of the revenues are generated with residential, commercial and industrial projects in Singapore.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Only 10% of the revenues come from projects abroad.

Keong Hong Holdings Ltd (5TT.SI) is a Singapore based construction company and property developer. The company is furthermore engaged in joint property investments with partners and associates. Currently, around 90% of the revenues are generated with residential, commercial and industrial projects in Singapore.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Only 10% of the revenues come from projects abroad.

Keong Hong is exploring more and more investment opportunities outside its home market and the cyclical construction business. Singapore’s continued weakness in the building sector offers little growth potential. Malaysia, Indonesia, Vietnam, Australia, and Japan are in focus. The company just recently announced its second acquisition of a commercial property in Osaka. Investments in commercial and hotel properties will provide a more consistent return to the company. Keong Hong’s hotel portfolio includes already two hotels in Singapore (Holiday Inn Express Singapore Katong and Hotel Indigo Singapore Katong) and one, just recently completed resort on the Maldives (Mercure Maldives Kooddoo Resort).

Keong Hong’s order book has increased by 23% since the end of its fiscal year 2016 and stood at approximately 433m SGD at the end of June. The company’s current construction pipeline includes Parc Life, Seaside Residences, Raffles Hospital extension and a fourth hotel project on the Maldives, Pullman Maldives Maamutaa Resort, which will open doors in 2019.

Keong Hong was founded in 1983 and is headquartered in Singapore. The shares are listed on the main board of Singapore’s stock exchange since December 2011. Controlling shareholder is the chairman and CEO, Mr. Leo Ting Ping Ronald, with an ownership of 53%. 38% of the shares are in public hand.

With a workforce of over 400 employees, Keong Hong reported revenues of 136m SGD (100m USD) and profit before tax of 14m SGD (10m USD) over the first nine months of its fiscal year 2017. This is a decrease of 29% and 31% respectively compared to the same period a year ago. In 2016, revenues and profits fell already by 12% and 9% respectively. The decrease was mainly due to a lower recognition of revenues from construction projects in the reporting period, but also from a sluggish Singapore construction sector. Keong Hoong’s operating margin of 16% is on the other hand well above industry average. The company had cash reserves of 49m SGD (36m USD) at the end of June 2017. Keong Hong shows a solid balance sheet with an equity ratio of 43% and a still acceptable gearing, defined here as total liabilities to total equity, of 134%.

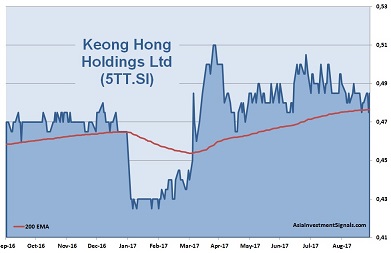

Keong Hong’s shares are in an uptrend since June 2012 and gained 155% in value since, but advanced by only 2% this year. The company is priced at four times earnings. The shares trade well below book value and at four times cash flow only. The last dividend payment yielded almost 7%.

Since our first presentation of the company in May 2016 (see: Keong Hong Holdings – Undervalued?) the stock price has increased by only 8%. Keong Hong seems a well-managed company. The strong balance sheet, the low valuation and the high dividend yield gives the stock more upside potential than downside risks. The company’s long-term strategy to diversify revenues and to generate a more stable income stream with property investments is promising but will take some time to show up in the results. We are optimistic that the company will surprise with further overseas projects soon. Results of its fiscal year 2017 will be announced end of November.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 Q1-3 only |

|

|---|---|---|---|---|---|---|---|

| EPS (SGDcents) | 5.9 | 14.9 | 12.2 | 8.2 | 16.4 | 15.1 | 4.5 |

| Change | 14% | 154% | -18% | -33% | 100% | -8% | -40% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 4 | 16 | 0.8 | 4 | 43% | 21% | 134% | 6.7% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]