China Sunsine Chemical Holdings Ltd. (CH8.SI) has already been our recommendation early this year. Since then, the world’s largest producer of rubber chemicals gained more than 50 percent and shows still a low valuation.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

China Sunsine Chemical Holdings Ltd. (CH8.SI) has already been our recommendation early this year. Since then, the world’s largest producer of rubber chemicals gained more than 50 percent and shows still a low valuation.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

China Sunsine Chemical runs three production facilities located in China with a total capacity of currently 152,000 tons per annum. By the end of this year, the capacity will be expanded to 172,000 tons, comprising rubber accelerators, insoluble sulfur, and anti-oxidant, all indispensable chemicals that are sold under the brand name ‘Sunsine’ to tire manufacturers. The company has a global market share of 18 percent for rubber additives and accelerators.

China Sunsine Chemical has over one thousand customers around the world and serves two-thirds of the global top tire makers, such as Bridgestone, Michelin, Goodyear, Pirelli, Yokohama. The customers base is well diversified with no individual customer contributing more than ten percent to the total revenue. The company runs its own heating plant to generate steam and electricity for the energy-intensive production processes.

China Sunsine Chemical is riding on the robust growth of the auto and tire manufacturers in China and implements a stringent environmental protection policy to stay ahead of competitors and to meet the rigorous environmental requirements imposed now by the Chinese government.

China Sunsine Chemical was founded in 1994 and is headquartered in Singapore. The shares are listed on the main board of Singapore’s stock exchange since 2007. The company’s shares can also be traded in Germany. Major shareholder is the company’s executive chairman, Mr. Xu Cheng Qiu, with a direct and indirect ownership of around 64 percent. 35 percent of the shares are in public hand.

With a workforce of 1030 employees, China Sunsine Chemical reported revenues of 1.9bn RMB (282m USD) and profits before tax of 281m RMB (43m USD) over the first nine months in 2017. This is an increase of 26 and 33 percent respectively compared to the same period a year ago. In 2016, revenues and profits increased 10 and 8 percent respectively. The company had eight consecutive years of sales volume growth since its IPO in 2007. The operating margin of 16 percent is around the industry average. China Sunsine Chemical had cash reserves of 461m RMB (70m USD) at the end of September 2017. The company shows a solid balance sheet with good profitability and financial strength. The equity ratio is at 82 percent and the gearing, defined here as total liabilities to total equity, at 22 percent only.

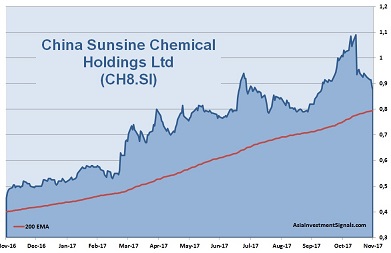

China Sunsine Chemical’s shares are in an uptrend since February 2016 and gained more than 217 percent in value since, 76 percent alone this year. The company is priced at eight times earnings only. The shares trade at 1.4 book value and at six times cash flow. The latest dividend yielded around 1.6 percent. Only one analyst is covering the company and rates it as an outperformer.

China’s economy grew by 6.9 percent during the first nine months of this year. Car manufacturers sold a more than 20m units in China, representing 4.5 percent growth on a year-to-year base. The company’s management remains positive to maintain a good performance in the next 12 months. With the excellent profitability and financial strength and the favorable valuation, we believe that China Sunsine Chemical’s shares have the potential to increase another 20-30 percent in the next six months.

AIS Rating: ★★★★☆

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 Q1-3 only |

|

|---|---|---|---|---|---|---|

| EPS (RMBcents) | 6.9 | 16.5 | 47.3 | 41.9 | 47.7 | 43.7 |

| Change | -67% | 141% | 187% | -11% | 14% | 31% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 8 | 20 | 1.4 | 6 | 82% | 19% | 22% | 1.6% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]