SoftBank Group Corp (9984.TYO) is the fifth largest public company in Japan and sixth-largest telecom operator in the world. Around 40 percent of the revenues are generated from the acquired US mobile service provider Sprint. SoftBank’s domestic mobile, broadband, and telco business in Japan contributes another 34 percent to the revenues.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The distribution of mobile devices overseas accounts for around 14 percent and the Yahoo Japan for about 9 percent of the revenues. In 2016 SoftBank acquired ARM Holdings, a now fully integrated company and a key player in the Internet-of-Things era with world-leading core technologies in semiconductor design.

SoftBank Group Corp (9984.TYO) is the fifth largest public company in Japan and sixth-largest telecom operator in the world. Around 40 percent of the revenues are generated from the acquired US mobile service provider Sprint. SoftBank’s domestic mobile, broadband, and telco business in Japan contributes another 34 percent to the revenues.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The distribution of mobile devices overseas accounts for around 14 percent and the Yahoo Japan for about 9 percent of the revenues. In 2016 SoftBank acquired ARM Holdings, a now fully integrated company and a key player in the Internet-of-Things era with world-leading core technologies in semiconductor design.

SoftBank keeps investing in tech companies and platform businesses around the world that have the potential to spark the next generation of innovations. The 2017 launched SoftBank Vision Fund is the largest technology investment fund ever with a volume of 100bn USD. SoftBank holds a stake of around 30 percent in the fund which capitalizes on the development of some well-known names such as Alibaba, WeWork, Uber, Grab, ARM, Nvidia, DiDi, OneWeb, Boston Dynamics.

To accelerate the transformation into one of the world’s biggest tech investors, SoftBank just announced the spin-off of its domestic mobile business by the end of this year. The listing could raise 18bn USD and could be one of the biggest IPOs by a Japanese company.

SoftBank was founded in 1981 and is headquartered in Tokyo, Japan. The shares are listed on Tokyo’s stock exchange since 1998. The company’s shares can also be traded in Germany, Switzerland and the US. Principle shareholder is the visionary founder and CEO, Mr. Masayoshi Son, with an ownership of around 21 percent. 79 percent of the shares are in public hand.

With a workforce of more 68,000 employees, SoftBank reported revenues of 4,411bn JPY (40bn USD) and profits before tax of 219bn JPY (2bn USD) over the first half-year 2017/18. This is an increase in sales of 3 percent and a decrease in profits of 67 percent compared to the same period a year ago. In 2016/17, revenues increased by 0.2 percent while profits decreased by 23 percent respectively. While operating income kept rising, the decline in income before taxes came mainly from losses in derivatives and other financial instruments. The operating margin of 14 percent remains below sector peers. SoftBank had cash reserves of 3,463bn JPY (31bn USD) at the end of September 2017. The company shows good profitability but a high debt burden. The equity ratio is at only 20 percent and the gearing, defined here as total liabilities to total equity, at worrying 412 percent. Moody’s current rating of SoftBank is Ba1 with a stable outlook.

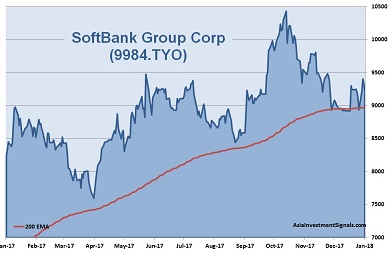

SoftBank’ shares are in an uptrend since February 2016 and gained more than 120 percent in value since, five percent alone this year. The company is priced at 14 times earnings. The shares trade at more than double book value and at eight times operating cash flow. The latest dividend yielded less than one percent. The majority of covering analysts rate the stock as a buy.

SoftBank’s founder and CEO is a visionary entrepreneur who drives the development of the digital revolution. The company is in the process to transform into a pure investment holding to capitalize on the best tech startups worldwide. But the shopping tour is expensive and keeps debt levels rising. Over the past three years, Softbank issued 29bn USD of new debt to reach over 100bn USD now. This could become a problem when interest rates rise, or the global tech industry experiences a setback. The spin-off of its domestic wireless business this year could bring some relief provided that the global markets remain stable.

On the other hand, SoftBank’s complicated structure and the constant stream of new investments makes it difficult to value the company correctly. Analysts often note that the market value does not accurately reflect the value of the holdings. SoftBank’s market capitalization currently stands at around 90bn USD while its 30 percent stake in Alibaba is worth around 142bn USD. These disparities seem not been discovered by most investors yet. The upcoming IPO of the domestic mobile spin-off may bring along some revaluation of SoftBank’s other holdings. The shares should have an upside potential of at least 20-30 percent this year.

AIS Rating: ★★★★☆

| 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 Q1 only |

|

|---|---|---|---|---|---|---|

| EPS (JPY) | 328 | 435 | 559 | 388 | 1276 | 85 |

| Change | 18% | 32% | 29% | -31% | 229% | -87% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 14 | 23 | 2.2 | 8 | 20% | 22% | 412% | 0.5% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]