China Overseas Land & Investment Ltd (0688.HK) is a leading real estate developer and state-owned red-chip (incorporated outside mainland China). China Overseas Land & Investment is specialized in high-rise apartment buildings and commercial properties in China’s first- and second-tier cities.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] While the company’s property development segment accounts for 98 percent of the revenues, the property investment segment contributes to more than 20 percent of the profits.

China Overseas Land & Investment Ltd (0688.HK) is a leading real estate developer and state-owned red-chip (incorporated outside mainland China). China Overseas Land & Investment is specialized in high-rise apartment buildings and commercial properties in China’s first- and second-tier cities.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] While the company’s property development segment accounts for 98 percent of the revenues, the property investment segment contributes to more than 20 percent of the profits.

China Overseas Land & Investment has currently projects in 56 mainland Chinese cities, as well as Hong Kong and Macau. Hong Kong and Macau contribute only to around 5 percent of the revenues and about 4 percent of the company’s non-current assets. China Overseas Land & Investment also owns four properties in London which contribute less than one percent to the revenues but make up for around 9 percent of the non-currents assets. At the end of June 2017, the total land bank of China Overseas Land & Investment was 59m sqm. Together with its associate China Overseas Grand Oceans Group Ltd, the land bank totaled around 76m sqm.

China Overseas Land & Investment was founded in 1979 and is headquartered in Hong Kong. The shares are listed on Hong Kong’s stock exchange since 1992. At first a red chip, the company became later a blue chip with the entry in the Hang Seng Index in 2007. China Overseas Land & Investment’s shares can furthermore be traded in Germany and the US. Major shareholder is China State Construction Engineering Corporation Ltd, the largest construction conglomerate in China, with an ownership of around 56 percent, followed by CITIC Ltd, the biggest diversified conglomerate in China, with an ownership of about 10 percent. 34 percent of the shares are in public hand.

With a workforce of 5,500 employees, China Overseas Land & Investment reported revenues of 87bn HKD (11bn USD) and profits before tax of 33bn HKD (4bn USD) over the first half year 2017. This is an increase of 3 percent and 22 percent respectively compared to the same period a year ago. However, property sales increased by a whopping 34 percent during that period. The company also reported a good start in this year with contracted property sales up 30 percent in January compared to the same month a year ago. In 2016, revenues decreased by 3 percent while profits increase by 11 percent. Property sales increased by 17 percent during that period.

The operating margin of 36 percent is around industry average. China Overseas Land & Investment had cash reserves of 116bn HKD (15bn USD) at the end of June 2017. The company shows a solid balance sheet with acceptable financial strength, reduced debt levels, and good profitability. The equity ratio is at 41 percent and the gearing, defined here as total liabilities to total equity, at a bit too high 142 percent. Moody’s rates China Overseas Land & Investment’s credit risk medium grade (Baa1) and a stable outlook.

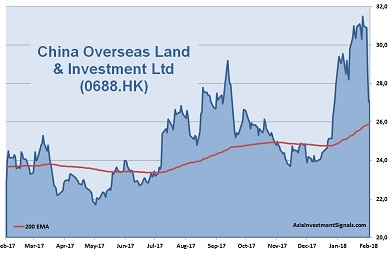

China Overseas Land & Investment’s shares are in an uptrend since beginning 2017 and gained more than 30 percent in value since, eight percent increase alone this year. The company is currently priced at seven times earnings. The shares trade slightly above book value and at five times cash flow only. The latest dividend yielded almost three percent. 24 out of 28 covering analysts rate the company as an outperformer or a buy.

China Overseas Land & Investment is a leading developer in China and has as a state-owned red-chip a strong execution and corporate governance track record. The company should have sufficient land bank to power its near-term growth. China Overseas Land & Investment shows a satisfactory financial strength and good profitability. The valuation is moderate. Expected market consolidation in China presents more opportunities than challenges for the company. With its property sales target of 400bn HKD by 2020 (2016: 211bn HKD) and the glut of housing in China, the company will be very likely look for opportunities abroad. With a stabilizing global stock market, hopefully in the next few weeks, we expect an increase in the share price of around 20 percent this year.

AIS Rating: ★★★★☆

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 H1 only |

|

|---|---|---|---|---|---|---|

| EPS (HKD) | 2.3 | 2.8 | 3.3 | 3.8 | 3.6 | 2 |

| Change | 21% | 23% | 19% | 13% | -3% | 13% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 7 | 36 | 1.2 | 5 | 41% | 19% | 142% | 2.9% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]