China Oriental Group Company Ltd (0581.HK) is a manufacturer and trader of iron and steel products. The company is furthermore engaged in the real estate business. China Oriental Group is ranked 241st among Fortune China 500 companies.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] With a sales volume reaching almost 12 tons last year, China Oriental Group is also one of the largest suppliers in the country. The company has a leading position for H-section steel products and has ambitions to become one the largest section steel producer in the world.

China Oriental Group Company Ltd (0581.HK) is a manufacturer and trader of iron and steel products. The company is furthermore engaged in the real estate business. China Oriental Group is ranked 241st among Fortune China 500 companies.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] With a sales volume reaching almost 12 tons last year, China Oriental Group is also one of the largest suppliers in the country. The company has a leading position for H-section steel products and has ambitions to become one the largest section steel producer in the world.

China Oriental Group has manufacturing facilities in the Hebei and Guangdong Provinces and targets mainly customers in Northern China so far. The top five largest customers account for less than 30 percent of the revenues. The company’s real estate business, which also operates locally only, contributes three percent to the total revenues. With the help of government grants, China Oriental Group started to invest in semiconductor technologies last year to diversify its business.

China Oriental Group was founded in 2003 and is headquartered in Hong Kong. The shares are listed on the main board of Hong Kong’s stock exchange since 2004. The company’s shares can also be traded in Germany and the US. Major shareholder is ArcelorMittal with an ownership of around 37 percent, followed by the company’s chairman, Mr. Han Jingyuan, with an ownership of about 34 percent. 28 percent of the shares are in public hand.

With a workforce of 9,700 employees, China Oriental Group reported record revenues and profits of 41bn RMB (6.5bn USD) and 6.4bn RMB (1bn USD) respectively in 2017. This is an increase of 56 and 507 percent respectively compared to the same period a year ago. The increase was due to selling prices that increased by more than 50 percent last year. Sales volume, on the other hand, increased by 3.5 percent last year. In 2016, revenues rose by 25 percent while profits dropped by 219 percent.

During the first three months of this year, the company reported a sales volume of self-manufactured steel products of approximately 2.7m tons, which is around 23 percent of the total sales volume reached in 2017. The operating margin of 15 percent is above the industry average. China Oriental Group’s cash reserves increased by 114 percent to 2.8bn RMB (432m USD) at the end of 2017. The company shows a solid balance sheet with good profitability and financial strength. The equity ratio is at 58 percent and the gearing, defined here as total liabilities to total equity, at 73 percent. Next results will be announced mid of August.

The key players in China’s steel industry remain optimistic for the ongoing year. The conditions of the steel industry in China has improved significantly since 2017 and resulted in structural reforms of the sector. Under the execution of several government policies to reduce overcapacity, to crack down on illegal sub-standard steel, as well as multiple environmental protection policies, the supply and demand balance in the industry has been further strengthened. Continued investments in infrastructure projects and a booming real estate sector have kept inventories in the steel industry at a relatively low level and led to increased steel prices. At the same time, raw material prices did not follow steel prices which substantially improved margins in the industry.

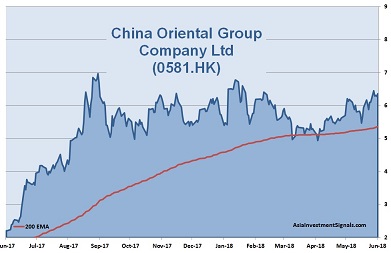

China Oriental Group’s shares are in an uptrend since February 2017 and gained more than 440 percent in value since, 8 percent increase alone this year. The company is priced at four times earnings. The shares trade slightly above book value and at four times cash flow only. The latest dividend yielded more than 5 percent. The majority of covering analysts rates the stock between outperformer and buy.

Our Conclusion: China Oriental Group shows a healthy balance sheet with good profitability and financial strength. The valuation is low and reduces the downside risk of an investment. The industry outlook remains moderately favorable for the ongoing year with an expected growth rate of 0.6 percent.

The company is well positioned in a strong competitive environment and not directly affected by any US trade war threads. Revenues and profits grew on average by five and 300 percent respectively over the last three years. Assuming continued stable economic conditions in China, we expect the share price to increase between 15 and 20 percent over the next 12 months.

AIS Rating: ★★★★☆

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| EPS (RMBcents) | 0.04 | 0.03 | 0.02 | -0.26 | 0.25 | 1.37 |

| Change | -90% | -25% | -33% | -1400% | 196% | 448% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 4 | 25 | 1.4 | 4 | 58% | 43% | 73% | 5.6% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]