Sino Biopharmaceutical Ltd (1177.HK) is one of the top health care companies in China. The company is ranked among Fortune’s China’s Top 500 Companies, Forbes Asia’s Fabulous 50 and Forbes’ Global 2000 as one of the world’s largest public companies.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Sino Biopharmaceutical Ltd (1177.HK) is one of the top health care companies in China. The company is ranked among Fortune’s China’s Top 500 Companies, Forbes Asia’s Fabulous 50 and Forbes’ Global 2000 as one of the world’s largest public companies.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Sino Biopharmaceutical is an integrated biotech company which primary business is the research, development, manufacturing, and sales of chemical and biopharmaceutical medicines mostly to Hong Kong and China. The company spends almost 11 percent of its revenue on R&D, which is among the highest in China, and employs an 11,000 strong sales force to reach over 90 percent of China’s hospitals.

Sino Biopharmaceutical focuses its R&D efforts on new hepatitis, cardio-cerebral, oncology, analgesic, and respiratory system medicines. Hepatitis drugs are the blockbuster and represent almost one-third of the company’s revenue. 489 pharmaceutical products obtained clinical approval, were under clinical trial, or applied for production approval.

Sino Biopharmaceutical is furthermore involved in the property holding, the sales of health food, the manufacturer, and optometry of optical glasses, as well as the retail and wholesale of optical and auditory products through its subsidiaries.

Sino Biopharmaceutical was founded in 2000 and is headquartered in Hong Kong. The company is listed on the Hong Kong’s stock exchange since 2000 and is since September 2018 a constituent of the Hang Seng Index. Its shares can also be traded in Germany and the US. Major shareholder is the vice chairlady Ms. Cheung Ling Cheng with ownership of around 23 percent, followed by the founder and CEO Mr. Ping Tse with ownership of about 15 percent. Fifty percent of the shares are in public hand.

With a workforce of over 21 thousand employees, Sino Biopharmaceutical reported revenues of 15.7bn RMB (2.3bn USD) and profits before tax of 1.5bn RMB (217m USD) during the first nine months of 2018. This is an increase of 37 and 55 percent respectively compared to the same period a year ago. In 2017, revenues and profits increased by 9 and 31 percent respectively. The operating margin of 23 percent is well above industry average. Sino Biopharmaceutical’s cash reserves increased by 50 percent to 6.3bn RMB (932m USD), while debts also increased by 21 percent to 3.6bn RMB (526m USD) over the three quarters of 2018. The company shows a solid balance sheet with excellent profitability and financial strength. The equity ratio is at 68 percent and the gearing, defined here as total liabilities to total equity, at 47 percent. Next results will be announced at the end of March.

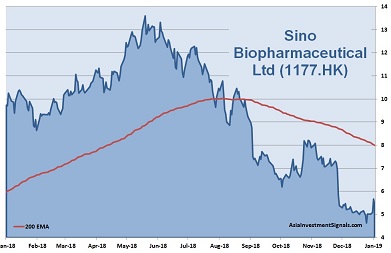

After a strong uptrend which peaked in May 2018, Sino Biopharmaceutical’s shares have lost 60 percent in value since. The company is currently priced at 29 times earnings, six times book value and 17 times cash flow. The latest dividend yielded less than one percent. 11 out of 23 analysts have a ‘buy’ recommendation on the stock.

Our conclusion: The company shows a healthy balance sheet with excellent profitability and financial strength. The valuation is high but in line with a strong growth in revenues and profits, which grew by 23 and 34 percent respectively over the last five years.

The industry outlook is promising with an aging population and a growing middle class in Asia that demands quality health care services. The company is well positioned in a strong competitive environment and holds some important patents. With a solution in the Sino-US trade dispute and a continued stable global economy, we expect the share price to increase at least 20 percent this year.

AIS Rating: ★★★★☆

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 Q1-3 only |

|

|---|---|---|---|---|---|---|

| EPS (RMB) | 21 | 31 | 24 | 25 | 25 | 20 |

| Change | 16% | 46% | -22% | 3% | 43% | 14% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 29 | 34 | 6 | 17 | 68% | 24% | 47% | 0.7% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]