Chuang’s China Investments Ltd (0298.HK) is an investment holding. The company invests and develops residential, commercial and hotel properties in Hong Kong, China and lately also in London. The company furthermore operates a cemetery, manufactures and trades goods and merchandises such as watch components and art pieces, and trades securities.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Almost 90% of the company’s business is done with properties in China. Chuang’s China Investments maintains currently a land reserve of over 3.5m sqm in China, sufficient to support its development over the next five to seven years. With its first property investment in London, the company starts to look for further growth opportunities in developed countries.

Chuang’s China Investments Ltd (0298.HK) is an investment holding. The company invests and develops residential, commercial and hotel properties in Hong Kong, China and lately also in London. The company furthermore operates a cemetery, manufactures and trades goods and merchandises such as watch components and art pieces, and trades securities.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Almost 90% of the company’s business is done with properties in China. Chuang’s China Investments maintains currently a land reserve of over 3.5m sqm in China, sufficient to support its development over the next five to seven years. With its first property investment in London, the company starts to look for further growth opportunities in developed countries.

Chuang’s China Investments is confident about the future growth of China’s economy and the demand for housing in first and second tier cities. The company expects a robust property market in China due to the increase of income, the strive to improve living conditions, and the increasing attractiveness of Renminbi assets.

The Hong Kong based company was founded in 1989 and listed on Hong Kong’s Stock Exchange. 58% of the shares are held by Chuang’s Consortium International Ltd, a Hong Kong listed holding controlled by Mr. Alan Chuang. The balance is held by the public. The shares can also be traded in Germany.

With a workforce of 214 employees, Chuang’s China Investments reported revenues of 491m HKD (63m USD) and a profit before tax of 1.6bn HKD (210m USD) for its fiscal year 2017. This is an increase of 4.5% and 655% respectively compared to the same period a year ago. The strong growth is due to the disposal of a project in Dongguan for a profit of 1.2bn HKD. In 2016, revenues were down 53% and 17% respectively compared to the year before. The average operating margins over the last five years have been 72% which is well above industry average. Chuang’s China Investments had a cash reserve of 1.3bn HKD (159m USD) at the end of March 2017. The company shows a solid balance sheet with an equity ratio of 63% and a gearing, defined here as total liabilities to total equity, of only 59%.

Net asset value attributable to equity holders increased by 62% to 4bn HKD in 2017, which is around 1.72 HKD per share. Compared to the current share price of 0.69 HKD this looks like a real bargain and was also a reason for the company to repurchase around 3% of its shares in recently.

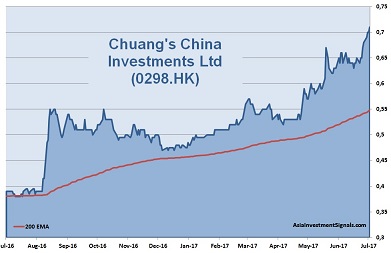

Chuang’s China Investments shares are in an uptrend since May 2016 and gained 122% in value since, 48% alone this year. The company is currently priced at only one time earnings compared to 29 times among its sector peers. The shares trade well below book value and at one time cash flow only. The last dividend payment yielded 5%.

AIS Rating: ★★★★☆

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| EPS (HKDcents) | 29.46 | 2.62 | 7 | 5.5 | 4.91 | 61.57 |

| Change | 1310% | -91% | 167% | -21% | -11% | 1154% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 1 | 29 | 0.4 | 1 | 63% | 44% | 59% | 5% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]