Nintendo Co. Ltd. (7974.T) is one of the top five video game makers in the world and number one in terms of game console sales. The products include portable and home console hardware systems as well as related software. Nintendo developed some well-known blockbuster video games such as Super Mario, Donkey Kong, The Legend of Zelda, and Pokémon.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company started some 130 years ago with the production of handmade Japanese playing cards. Today, Nintendo is on Forbes’ list of Growth Champions and Global 2000 companies.

Nintendo Co. Ltd. (7974.T) is one of the top five video game makers in the world and number one in terms of game console sales. The products include portable and home console hardware systems as well as related software. Nintendo developed some well-known blockbuster video games such as Super Mario, Donkey Kong, The Legend of Zelda, and Pokémon.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company started some 130 years ago with the production of handmade Japanese playing cards. Today, Nintendo is on Forbes’ list of Growth Champions and Global 2000 companies.

Nintendo was founded in 1889 and is headquartered in Kyoto, Japan. The company is listed on Osaka’s and Kyoto’s stock exchange since 1962, and on the First Section of Tokyo’s stock exchange since 1983. The shares can also be traded in Germany, Austria, Mexico, the UK, and the US. Major shareholder is the JP Morgan Chase Bank with ownership of around 11 percent. 78 percent of the shares are in public hand.

With a workforce of 5,944 employees, Nintendo reported revenues of 1.2tn JPY (10.8bn USD) and profits before tax of 272bn JPY (2.4bn USD) during its fiscal year ending March 2019. This is an increase of 14 and 35 percent respectively compared to the same period a year ago. In 2018, revenues and profits increased by 116 and 75 percent respectively. The operating margin of about 21 percent is well above the industry average. Nintendo’s cash reserves increased by 21 percent to 585bn JPY (5.2bn USD). The company has no debts and shows a rock solid balance sheet with excellent profitability and financial strength. The equity ratio is at 84 percent and the gearing, defined here as total liabilities to total equity, at 19 percent. Next earning results will be announced at the end of July.

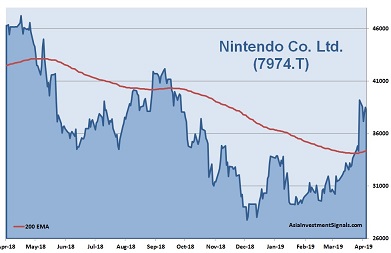

After a sharp decline of more than 40 percent over the last year, Nintendo’s shares bottomed in late December and gained 37 percent in value since, 30 percent alone this year. The 200-moving-average-line has just begun to turn upwards again this month, a positive signal. The company is priced at 24 times earnings, 3.2 times book value and 25 times cash flow. The latest dividend yielded a bit over two percent. 14 out of 17 analysts have currently a ‘buy’ or ‘outperform’ recommendations on the stock.

Our conclusion: Nintendo shows a healthy balance sheet with excellent profitability and financial strength and no debts. The valuation is high but comes with growth rates of 24 and 49 percent for revenue and profits over the last three years. The industry outlook is positive with forecasted growth rates of over 9 percent annually for the video game market over the next years. The continuous penetration of smartphones and the improvement of internet access and speed are the key drivers for growth over the next years. Much phantasy is arising currently from Nintendo’s deal with Tencent to sell its Switch video game system in China. Further cooperation with other game and tech giants might follow.

The company is well positioned in an intensely competitive environment. In a continuing stable growing global economy, we expect the share price to increase by 10 to 15 percent until the end of this year.

AIS Rating: ★★★★☆

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| EPS (JPY) | -184 | 354 | 137 | 854 | 1162 | 1616 |

| Change | -431% | 293% | -61% | 521% | 36% | 39% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 24 | 20 | 3.2 | 25 | 84% | 14% | 19% | 2.1% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]