Government bond yields are continuing decreasing around the world with some countries reaching already negative yields for their 10-year bonds such as in Switzerland, Germany, Netherlands, France, and Japan. How does the situation look around Asia-Pacific? Where to park money safely in Asia when not invested in the equity markets?[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Government bond yields are continuing decreasing around the world with some countries reaching already negative yields for their 10-year bonds such as in Switzerland, Germany, Netherlands, France, and Japan. How does the situation look around Asia-Pacific? Where to park money safely in Asia when not invested in the equity markets?[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

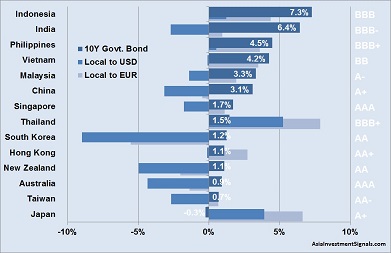

The graph shows the latest yields for 10-year government bonds (dark blue) in the Asia-Pacific region. On the right side of the chart, the latest Standard & Poor country rating, which indicates the long-term credit rating for those sovereign bonds. According to S&P, a bond is considered investment grade if its credit rating is BBB- or higher. Ratings of BB+ and below are supposed to be speculative or junk grade.

The graph shows furthermore the change in the local currency against the US Dollar (middle blue) and the Euro (light blue) on a year to date basis. 10-year government bonds currently yield the highest in Indonesia with 7.3 percent, followed by India (6.4 percent) and the Philippines (4.5 percent). On the lower end, Japanese government bonds have a negative of 0.3 percent, followed by Taiwanese (0.7 percent) and Australian bonds (0.9 percent).

How much return remains in the pocket of a US or European based investor depends on the development of the local currencies against the USD or the EUR. Most currencies in the Asia-Pacific region have lost against the USD since the beginning of this year. The highest loss experienced the South Korea Wong (KRW) with 9 percent, followed by the New Zealand Dollar (NZD) with 5 percent and the Australian Dollar (AUD) with 4.3 percent. Currencies in Thailand, Japan, Indonesia, and the Philippines rose against the USD on the other hand. The Thailand Baht (THB) gained even more than 5 percent against the USD this year.

The picture looks slightly different for a EUR based investor. Most Asia-Pacific currencies increased against the EUR this year. The highest increase experienced the Thailand Bath (THB), which rose 7.9 percent against the EUR, followed by the Japanese Yen (JPY) with 6.6 percent. The Korea Wong (KRW), on the other hand, decreased not only sharply against the USD but also against the EUR with a loss of more than 5 percent this year.

The best investment in 10-year government bonds at a still acceptable risk level would have made a EUR based investor in Indonesia. The country has a BBB rating with a stable outlook, and its government bond yields 7.3 percent currently. This yield comes with an increase of its Indonesian Rupiah (IDR) of 4.4 percent against the EUR and 1.2 percent against the USD.

[/mepr-active]