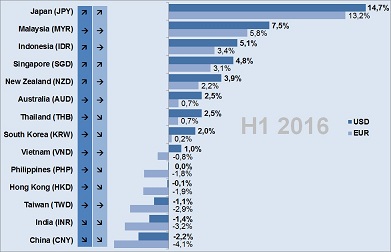

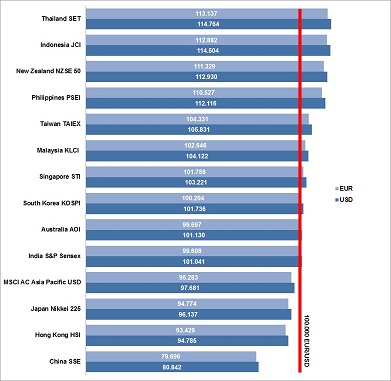

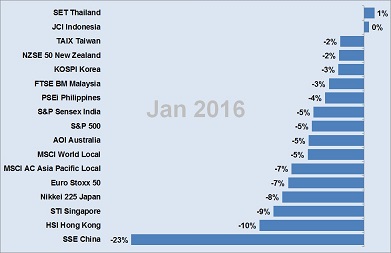

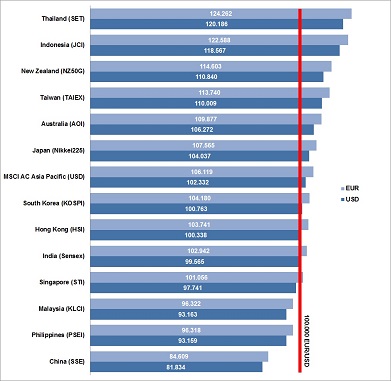

What would have a 100K EUR or USD investment returned to an investor in 2016 when he or she would have invested in one of the Asia Pacific equity markets? Our regular snapshot ranks the performance of APAC‘s stock markets in 2016 on a USD and EUR base.

What would have a 100K EUR or USD investment returned to an investor in 2016 when he or she would have invested in one of the Asia Pacific equity markets? Our regular snapshot ranks the performance of APAC‘s stock markets in 2016 on a USD and EUR base.

Best return with 24.2% has received an EUR based investor with Thailand stocks last year. Continue reading “What a 100K Investment in Asia Pacific Returned in 2016”