Valuetronics Holdings Limited (BN2.SI) is an investment holding company and integrated EMS (electronics manufacturing services) provider for OEM and ODM customers in industrial and commercial electronics, medical equipment and consumer electronics. The company serves international clients in America, Europe and the Asia-Pacific with well-known brands such as NTT, DYMO, HID, Philips, and KitchenAid.

Valuetronics Holdings Limited (BN2.SI) is an investment holding company and integrated EMS (electronics manufacturing services) provider for OEM and ODM customers in industrial and commercial electronics, medical equipment and consumer electronics. The company serves international clients in America, Europe and the Asia-Pacific with well-known brands such as NTT, DYMO, HID, Philips, and KitchenAid.

Valuetronics operates in two segments: Consumer Electronics (CE) and Industrial and Commercial Electronics (ICE). The CE segment has suffered from a slowdown in demand for LED lighting products. Valuetronics wants to focus more on consumer lifestyle products as over 90% of the LED products have reached the end of their product lifecycle.

The company’s profit margin comes from the ICE segment. The double-digit growth in revenues in this segment is generated from existing customers and new income streams derived from electronic products for the automotive industry. New products include telecommunication products for commercial application, high-precision global positioning system (GPS) products, temperature sensing devices, and transactions printers. These new businesses offer the potential for further growth.

The company shows a healthy working capital with operating activities that are generating a strong cash flow. Headwind is expected from a stronger US dollar and a further slowdown in China’s economy. Despite unforeseen circumstances, the directors remain positive on the company’s overall profitability for the current financial year ending March 2016.

The Singapore-listed company with headquarter in Hong Kong has its main manufacturing facility located in the nearby Guangdong Province.

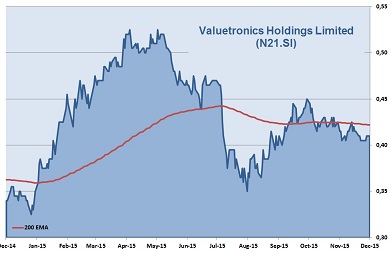

We like Valuetronic’s low P/E valuation of only 7.7 times earnings which is around half of its peer industry. This comes with a dividend yield of 5% and basically no debts. We want to capitalize on these good fundamentals and open a position in our model portfolio with the purchase of 42,000 shares at close today. We expect the stock to see old highs in the next six months.

Asia Investment Signals’ Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016e | |

|---|---|---|---|---|---|---|

| EPS | 34 | 36 | 22 | 40 | 40 | 38 |

| Change | 6% | -40% | 85% | -1% | -5% | |

| P/E: P/E Industry: P/B: Debt to Capital: |

8.3 17 1.5 0 |