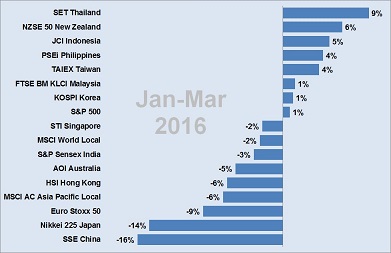

While US (1%) and Europe (-9%) are still struggling from a bad start in January, we see some well performing markets across Asia Pacific.

While US (1%) and Europe (-9%) are still struggling from a bad start in January, we see some well performing markets across Asia Pacific.

Thailand and Indonesia, hardly affected by January’s general market turmoil, continue to follow up on a good trend already shown in January with now 9% respectively 5% up.

New Zealand, Taiwan and Philippines have ironed out the little dips in January and have advanced 4% to 6% until now.

Singapore has recovered 7% since end of January and might continue to profit of the positive trend of its South East Asian neighbors.

India, the market most analyst have predicted to become an outperformer this year, remains weak with minus 3% up to date.

China, the problem child of this year, has caught up 7% from its low of minus 23% end of January. China might end this year with a red figure, but we expect some more recovery in performance until end of this year.

Australia, Hong Kong, Korea and Malaysia will highly depend on China’s performance. But their rate of recovery might indicate only underperforming results for this year.

Japan continues to struggle from a weak global and domestic demand. The Japanese market is down another 6% since end of January with only little perspectives left for the rest of this year.

Read also: Much Ado About Nothing?