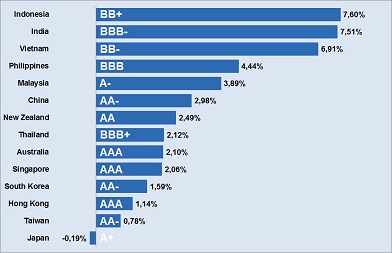

While government bond yields in many western developed countries swing around the zero mark or are even negative we can still find some well yielding bonds which come with moderate risk around Asia Pacific. The following graph gives an overview of the 10-year government bond yields and the corresponding (S&P) credit rating across Asia Pacific countries.

While government bond yields in many western developed countries swing around the zero mark or are even negative we can still find some well yielding bonds which come with moderate risk around Asia Pacific. The following graph gives an overview of the 10-year government bond yields and the corresponding (S&P) credit rating across Asia Pacific countries.

The rating agency S&P considers a bond to be of investment grade if its credit rating is BBB- or higher. In this category falls India with a 10-year government bond which yields currently at 7.5% and comes with a BBB- rating, which means that the country have adequate capacities to meet its financial commitments. With a bit more safety (BBB) comes the 10-year government bond of the Philippines, which yields currently at 4.4%.

Grade A qualities, with a strong capacity to meet financial commitments, shows Malaysia (A-) and China (AA-) with a current yield of 3.9% and 3% respectively. China and Hong Kong are put on a negative watch, which means that the rating could be lowered in the near future. The Brexit discussion has currently some effects on bond yields worldwide, but those political events are known to have short term effects only.

One of the safest bond investments according to Euromoney Country Risk monitoring is Singapore which ranks third among the least risky countries in the world. Singapore’s triple A safety comes with a 10-year government bond yield of only 2.1%, still ahead of many of its peers.

We will have also a closer look at the developments of government bond yields, GDP and currency exchange rates in one of our next postings in order to give EUR and USD investors a full picture for any bond investment in Asia Pacific. Stay tuned!