Folkestone Education Trust (FET.AX) is a property trust which invests in childcare centers in Australia and New Zealand, basically a landlord in the childcare early learning sector. The company, which was formerly known as Peppercorn Investment Fund then as Australian Education Trust before it changed to its current name as part of a restructuring in 2004, was founded in 2002 and is headquartered in Melbourne. Folkestone is listed as an A-REIT on the Australian ASX300 since May 2003.

Folkestone Education Trust (FET.AX) is a property trust which invests in childcare centers in Australia and New Zealand, basically a landlord in the childcare early learning sector. The company, which was formerly known as Peppercorn Investment Fund then as Australian Education Trust before it changed to its current name as part of a restructuring in 2004, was founded in 2002 and is headquartered in Melbourne. Folkestone is listed as an A-REIT on the Australian ASX300 since May 2003.

Folkestone owns 396 leasehold and freehold properties in Australia and New Zealand with a total carrying value of around 676m AUD. A market share of just 6% among the key long day care landlords in Australia gives the company potential for growth through acquisitions. The 28 long term tenants are generating around 52m AUD per year. An average lease expiry of 7.8 years makes the income predictable and quite stable to investors. The rate of occupancy is almost 100%. Goodstart Early Learning, Australia’s largest not-for-profit childcare operator with 641 childcare centers nationwide, is Folkstone’s largest tenant and contributes 60% to the company’s rental income.

The childcare industry is expected to grow strongly over the next few years in Australia. Positive effects are coming from the mini baby boom, the high migration levels, the continued government support and the increased rate of female workforce participation due to higher living cost. Employment rates for women with kids in Australia are still among the lowest in OECD countries.

Folkestone estimates around half a million more children under the age of five in the next 15 years which translates into an additional demand of 555 childcare centers over the next decade. Childcare is strongly supported and subsidized by the government. 80% of the total revenue of the Australian childcare industry is subsidized by the government. Government expenditures in this sector are projected to increase to 11.1bn AUD per year by 2022.

Folkestone’s business model benefits strongly from this government support. Minimal capex exposure, through predominantly triple net leases, geographical diversification, strong underlying land values, pooled bank guarantees from tenants are further arguments for an investment. Growth of population and improvements in infrastructure will boost land prices and appreciate Folkestone’s underlying property values.

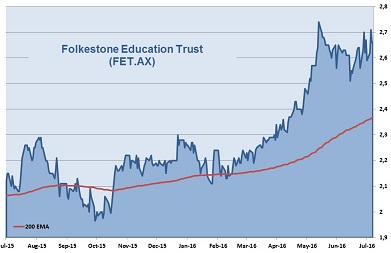

The company shows strong fundamentals with a share price that gained 1570% in a continuously uptrend since March 2009. Dividend has grown at an average of 9.5% p.a. in the last five years, with a yield of 5% currently. The company is currently priced at 6.8 times its earnings. Although all covering analysts have reduced their outlook for Folkestone to hold only, we see the company still as a solid investment that provides a quite secure long term cash-flow with limited risks and good potential for further capital growth.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | H1 2016 only |

|

|---|---|---|---|---|---|---|

| EPS (AUD cents) | 1.65 | 13.23 | 22.64 | 27.91 | 39.5 | 24.16 |

| Change | -39% | 702% | 71% | 23% | 42% | -5% |

| P/E | P/E Industry |

P/B | P/CF | Equity Ratio |

ROE | Debt/ Capital |

Div YLD |

|---|---|---|---|---|---|---|---|

| 6.8 | 28 | 1.3 | — | 70% | 23% | 44% | 5% |