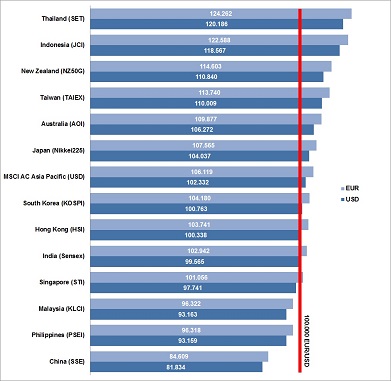

What would have a 100K EUR or USD investment returned to an investor in 2016 when he or she would have invested in one of the Asia Pacific equity markets? Our regular snapshot ranks the performance of APAC‘s stock markets in 2016 on a USD and EUR base.

What would have a 100K EUR or USD investment returned to an investor in 2016 when he or she would have invested in one of the Asia Pacific equity markets? Our regular snapshot ranks the performance of APAC‘s stock markets in 2016 on a USD and EUR base.

Best return with 24.2% has received an EUR based investor with Thailand stocks last year. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The worst performance with a loss of 18.2% has experienced a USD based investor with Chinese stocks.

The picture among the top performer has not changed much. Thailand (GDP 2016: 3.2%*), Indonesia (GDP 2016: 4.9%*), New Zealand (GDP 2016: 2.8%*) and Taiwan (GDP 2016: 1.0%*) have been leading the ranking list since the first quarter of 2016 (see: First Quarter Performance of APAC Markets – Visible Trends). Thailand and Indonesia were before among the worst performers in 2015. China (GDP 2016: 6.6%*) recovered to some extent from its January crash in the following three months, but remained the worst performing market in APAC in 2016.

Two countries made a surprising turn during the second half of 2016. The Philippines (GDP 2016: 6.4%*), which has been among the top five performers until mid of the year dropped heavily to become the second worst performing market during the second half of 2016. Investors have turned their back on an already highly valued market and the new president’s politic. A surprising turnaround has been seen in Japan (GDP 2016: 0.5%*) which gained strongly during the second half of 2016. A favorable yen and positive effects of PM Abe’s economy policy has helped the country to stop the downtrend and to finish the year with a profit, at least for a USD and EUR based investor.

India (GDP 2016: 7.6%*), the market with the highest expectations of analysts at the beginning of 2016 and a top GDP grower, remained almost unchanged during the year.

* IMF projected GDP growth for 2016

[/mepr-active]