The visualization and ranking of index performances with bar charts gives a quick comparative view on recent markets trends and an outlook for the rest of the year. We observed that many trends develop in January (see also: APAC Markets – First Trends for 2017) and last until the end of the year, provided that no significant incidences and turbulences will occur.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

The visualization and ranking of index performances with bar charts gives a quick comparative view on recent markets trends and an outlook for the rest of the year. We observed that many trends develop in January (see also: APAC Markets – First Trends for 2017) and last until the end of the year, provided that no significant incidences and turbulences will occur.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

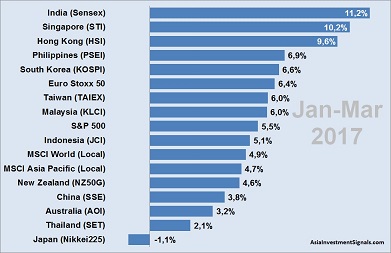

Top performers in our Asia Pacific regional ranking are currently India, Singapore and Hong Kong. India’s SENSEX index has shown the most dynamic grow among the APAC countries in the last two month with a gain of 7.2% since January to now 11.2%. Singapore’s stock market remains second best performing market in the region and grew by another 4.5% during the last two months to now 10.2%. Hong Kong’s stock market had to give up the number one position from January. Hong Kong’s HSI advanced by 3.4% since January to now 9.6%. The Philippines’ stock market grew by only 1.2% during the last two months to now 6.9%. Without significant upcoming turbulences, we expect these markets to progress another 5-10% this year.

South Korea, Taiwan, Malaysia and Indonesia which have shown no or only a moderate performance in January gained momentum during the last two months and advanced between 4% to 5% during that time. Noteworthy, Indonesia’s stock market caught up a strong 5.2% in the last two months.

New Zealand’s NZ50 index improved by only 2.1% during that time to now 4.6%. Moreover, Australia’s stock market turned a negative start in January into a moderate gain of 3.2%.

Japan’s NIKKEI225 index remains weak. The market was not able to follow up on the short spike after the US election in autumn. With 2.1%, Thailand’s stock markets remained almost unchanged during the last two months and ended up among the three worst performers in the APAC region. We nevertheless expect some surprises here for the second half of this year.

In comparison, Euro Stoxx 50 advanced a strong 8.2% since January to now 6.4%, S&P 500 rose 3.7% to now 5.5%, and the MSCI World grew by 3.7% to now 4.9%.

[/mepr-active]