PCI Limited (P19.SI) is a leading high technology electronics manufacturing services (EMS) provider. The company started 45 years ago as a printed circuit board manufacturer in the heart of Silicon Valley.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company serves today blue-chip customers such as Motorola, Xerox, Tecom, Roche, Qualcomm, Lucent Technologies, Philips, and Bosch.

PCI Limited (P19.SI) is a leading high technology electronics manufacturing services (EMS) provider. The company started 45 years ago as a printed circuit board manufacturer in the heart of Silicon Valley.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company serves today blue-chip customers such as Motorola, Xerox, Tecom, Roche, Qualcomm, Lucent Technologies, Philips, and Bosch.

With manufacturing facilities in Indonesia and China, PCI offers all services along the manufacturing outsourcing cycle, including engineering design and development, supply chain management, manufacturing, assembling, testing, and logistics. More than half of PCI’s revenues are generated in the US, followed by Ireland (18%), Singapore (10%) and China (9%). Three major customers account for more than a third of the revenues.

PCI was founded 1972 in Silicon Valley and is today headquartered in Singapore. The company is listed on the main board of Singapore’s stock exchange since 1995. PCI’s shares can also be traded in Germany. Major shareholder is Chuan Hup Holdings Ltd, a company controlled by PCI’s executive chairman and vice chairman, with an ownership of 77%. The balance is held by the public.

With a workforce of around 3,800 employees, PCI reported revenues of 199m USD and a profit before tax of 13m USD over its fiscal year 2017, which ends in June. This is an increase of 10% and 77% respectively compared to a year ago. In 2016, revenues and profits decreased by 5% and 67% respectively. The operating margin of 6.5% is above the industry average. PCI had cash reserves of 40m USD at the end of June. The company shows a solid balance sheet with an equity ratio of 59% and a gearing, defined here as total liabilities to total equity, of 69%.

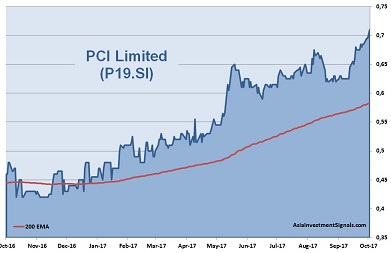

After many years of sideways movement, PCI’s shares have gained momentum since August 2016 and increased by more than 80% in value since, 55% alone this year. The company is currently priced at ten times earnings only. The shares trade only slightly above book value and at five times cash flow. The last dividend yielded almost 8%.

PCI operates in an industry that provides abundant opportunities thanks to increases in complexity and evolving markets, such as the Internet of Things. The EMS industry is expected to grow at more than five percent during the next five years. However, EMS providers are challenged with rising manufacturing costs and price pressure from original equipment manufacturers as well as rapidly evolving electronics design, functionality, and component sizes. Only companies that look internally for smart, cost-saving strategies, maintain flexible and responsive production solutions and act as technology enablers will be the future winners. PCI seems to be on the right track. The company comes with healthy financials and a reasonable valuation. We expect another 20-30 percent share price increase during the next twelve months.

AIS Rating: ★★★★☆

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| EPS (USDcents) | 1.75 | 2.86 | 10.14 | 2.88 | 5.34 |

| Change | -61% | 63% | 255% | -72% | 85% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 10 | 16 | 1.2 | 5 | 59% | 13% | 69% | 8% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]