What would have a 100K USD, EUR or local currency investment returned to an investor in 2017 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

What would have a 100K USD, EUR or local currency investment returned to an investor in 2017 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

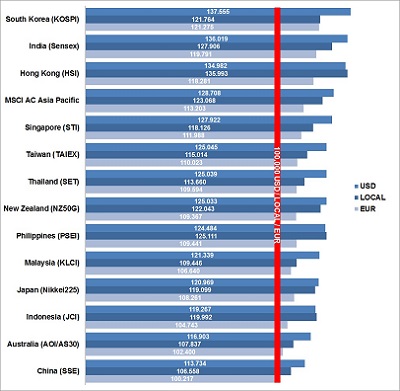

The highest return with a gain of 38% would have received a USD based investor with South Korean stocks in 2017. The lowest return with a little gain of less than 1% would have experienced an EUR based investor with Chinese shares.

The top performers in 2017 on a USD basis have been South Korea (38%) followed by India (36%), Hong Kong (35%), Singapore (28%) and Taiwan (25%). The ranking remains the same on an EUR basis, but with much lower returns of only 21%, 20%, 18%, 12% and 10% respectively. All APAC markets ended with gains for both the USD and EUR based investors. Even the laggards China, Australia, and Malaysia made at least a one digit percent return in 2017.

The ranking of the top performing Asian markets looks slightly different on a local currency basis. The top performers in 2017 on a local currency basis have been Hong Kong with a gain of 36% followed by India (28%), Philippines (25%), New Zealand (22%) and South Korea (22%).

Which will be the best-performing APAC markets in 2018? Let’s see the market momentum in January. The market performance and ranking during the first month of a year is a good indicator to forecast some developments of the next few months. Stay tuned for our next performance snapshot which we post in early February.

[/mepr-active]