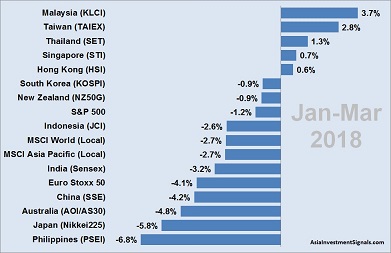

Our quarterly snapshot visualizes and ranks the performance of major stock market indices around Asia-Pacific. The graph gives a quick and comparative overview of recent developments and trends that could determine the direction of stock markets over the coming months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Our quarterly snapshot visualizes and ranks the performance of major stock market indices around Asia-Pacific. The graph gives a quick and comparative overview of recent developments and trends that could determine the direction of stock markets over the coming months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

The comparison with our January snapshot (see: APAC Markets: First Trends for 2018) shows very well the turbulence that most markets have experienced in the last two months. The ranking today looks very different from what we saw after the first month of this year.

Top performers in our Asia-Pacific ranking are now Malaysia, Taiwan, and Thailand which have replaced Hong Kong, India, and China since our last snapshot end of January. However, the picture is deceptive. Malaysia proved to be quite robust and remained almost unchanged since January. Taiwan and Thailand lost 1.5 and 2.8 percent respectively during the last two months, but still, show some decent gains this year.

The biggest losers in February and March were the equity markets, which performed exceptionally well in January, with an increase of more than 5 percent during this first month. China and India lost between 8 and 9 percent during the last two months and ended up in the red now. Hong Kong, which also lost more than 8 percent shows still a decent gain this year. The Philippines, which has already been lacking behind in the January rally, dropped almost 9 percent during the following two months and ended up as the worst performer in Asia-Pacific so far with a year-to-date (YTD) loss of nearly 7 percent.

Singapore’s and New Zealand’s stock markets surprised with strength in the recent turbulence. Both markets hardly increased during the January rally, but also hardly declined in the latest turbulence.

In comparison, the Euro Stoxx 50 lost in the last two months nearly 7 percent with a YTD loss of 4 percent, the S&P 500 fell 6.5 percent to a YTD loss of 1 percent and the MSCI World lost about 6 percent to a YTD loss of almost 3 percent.

All in all the stock markets in Asia-Pacific have fallen less than 10 percent, which can still be regarded as a market correction. A bearish market begins with a drawdown of more than 20 percent. The decline is healthy after the rapid increase in 2017 and early 2018. The trees can not grow in the sky. Investors reacted extremely nervously to any news that could affect the markets in any way. Despite the saber-rattling on the different political stages, the global economy is still in a good and stable condition. Political events can move the markets, but rarely for long.

We are optimistic that the year will end with gains in most Asia-Pacific markets, albeit perhaps in the single-digit percentage range. Hong Kong and Singapore could once again be among the top performers this year.

[/mepr-active]