Ryman Healthcare Limited (RYM.NZ) is one of the ten best-performing healthcare companies in the world. The company provides private health care services through the development, management, and operation of retirement villages for the elderly. The villages offer a range of retirement living and care options, including independent townhouses and apartments, serviced apartments, as well as a care centers with rest homes and hospitals.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The villages integrate a wide range of amenities such as lounges and bars, indoor swimming pools and spa, gym, hair and beauty salons, bowling greens, libraries, movie theatres, internet cafés. Ryman Healthcare operates currently 32 retirement villages in New Zealand and Australia with over 10,800 residents. 16 more villages are in the pipeline. 95 percent of the business is generated from New Zealand. Australia makes up only around 5 percent so far.

Ryman Healthcare Limited (RYM.NZ) is one of the ten best-performing healthcare companies in the world. The company provides private health care services through the development, management, and operation of retirement villages for the elderly. The villages offer a range of retirement living and care options, including independent townhouses and apartments, serviced apartments, as well as a care centers with rest homes and hospitals.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The villages integrate a wide range of amenities such as lounges and bars, indoor swimming pools and spa, gym, hair and beauty salons, bowling greens, libraries, movie theatres, internet cafés. Ryman Healthcare operates currently 32 retirement villages in New Zealand and Australia with over 10,800 residents. 16 more villages are in the pipeline. 95 percent of the business is generated from New Zealand. Australia makes up only around 5 percent so far.

Ryman Healthcare’s business model is a mixture of property development and healthcare services. Residents have to pay for a lifetime occupancy use of their apartments or units in the village, and upon moving out, a deferred management fee of up to 20 percent will be deducted from the payback sum of their residence. Management fees account for about 20 percent of the company’s revenues. The more significant part is generated through care fees, which account for around 79 percent of the company’s revenues. About one-third of the care fee revenues are government aged-care subsidies received from the Ministry of Health.

Ryman Healthcare was founded in 1984 and is headquartered in Christchurch, New Zealand. The shares are listed on New Zealand’s stock exchange since 1999. The company’s shares can also be traded in Germany and the US. Major shareholder is Geoffrey Cumming, a company director, with an ownership of around 10 percent, followed by the co-founder, Kevin Hickman, and his family with an ownership of about 7 percent. 79 percent of the shares are in public hand.

With a workforce of around 5,000 employees, Ryman Healthcare reported revenues of 343m NZD (233m USD) and underlying profits of 204m NZD (139m USD) over its fiscal year 2017/18. This is an increase of 18 and 14 percent respectively compared to the same period a year ago. In 2016/17, revenues and profits increased by 11 and 13 percent respectively. The operating margin of 17 percent is well above industry average. Ryman Healthcare’s free cash flow increased by 26 percent to 164m NZD (112m USD) over the recent fiscal year. The company invested all its remaining cash in new investment properties. The company shows a stable balance sheet with good profitability and satisfactory financial strength. The equity ratio is at 33 percent and the gearing, defined here as total liabilities to total equity, at 199 percent. Next results will be announced at the end of November.

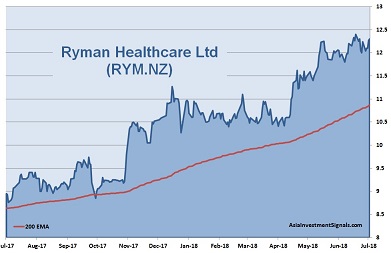

Ryman Healthcare’s shares are in an uptrend since June 2017 and gained almost 50 percent in value since, 16 percent alone this year. The company is priced at 16 times earnings, three times book value and 15 times cash flow. The latest dividend yielded one percent only. The majority of covering analysts have a ‘hold’ recommendation on the stock currently.

Our conclusion: The company shows a healthy balance sheet with good profitability and satisfactory financial strength. The valuation is, considering the earnings growth rate, reasonable. Revenues and earnings grew by 13 and 24 percent respectively over the last five years. Price/earnings to growth ratio is at 0.77 only. The company’s goal is to double the underlying profits every five years. The industry outlook is positive. The number of people aged 75+ in New Zealand is forecasted to nearly triple over the next 30 years. And the number of people aged 75+ in Victoria, the state in Australia where Ryman Healthcare plans to build seven more villages, is 40 percent greater than in New Zealand. The company is well positioned in a strong competitive environment. Assuming a stable global economy with a moderate increase of interest rates, we expect the share price to increase at least 20 percent over the next 12 months.

AIS Rating: ★★★★☆

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|

| EPS (NZDcent) | 27 | 39 | 48 | 61 | 71 | 78 |

| Change | 12% | 43% | 24% | 26% | 17% | 9% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 16 | 34 | 3 | 15 | 33% | 22% | 199% | 1.2% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]