‘There is time to go long, time to go short, and time to go fishing.’ said once Jesse Livermore, an American investor and security analyst in the early 20th century.

‘There is time to go long, time to go short, and time to go fishing.’ said once Jesse Livermore, an American investor and security analyst in the early 20th century.

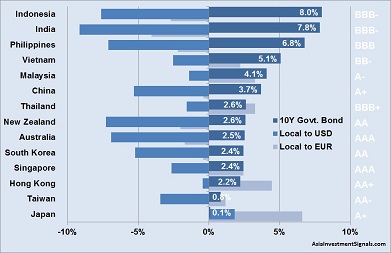

However, where to park the money safely in Asia when not invested in the stock market?[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The graph shows the latest yields of 10-year government bonds (dark blue) in the Asia Pacific region. On the right side of the chart, the Standard & Poor country rating which indicates the long-term credit ratings for these sovereign bonds. According to S&P, a bond is considered investment grade if its credit rating is BBB- or higher. Ratings of BB+ and below are supposed to be speculative or junk grade.

The graph shows furthermore the increase and decrease of each local currency against the USD (middle blue) and the EUR (light blue).

10-year government bonds currently yield the highest in Indonesia with 8.0%, followed by India (7.8%) and the Philippines (6.8%). On the lower end, Japanese government bonds yield currently 0.1%, followed by Taiwan (0.8%) and Hong Kong (2.2%).

How much return remains in the pocket of a foreign investor depends on the development of the currencies. Most currencies in the Asia Pacific region have lost against the USD since the beginning of this year. The highest loss experienced the Indian Rupee (INR) with 9.7%, followed by the Indonesian Rupiah (IDR) with 7.6% and the New Zealand Dollar (NZD) with 7.3%. Only one Asia Pacific currency rose against the USD. The Japanese Yen (JPY) gained 1.8% against the USD this year.

The picture looked different for an EUR investor. Many Asia Pacific currencies increased against the EUR this year. The highest increase experienced the JPY with 6.6% against the EUR, followed by the Hong Kong Dollar (HKD) with 4.4%. The India Rupee, on the other side, decreased not only strongly against the USD but also against the EUR with a loss of 4.1%.

The best and safest investment in Asia Pacific government bonds would have made an EUR investor in Hong Kong. The AA+ rated government bonds yield 2.2% plus the increase of the HKD against the EUR of 4.4% would have returned over 6% so far.

[/mepr-active]