Toyota Motor Corp (7203.T) is with over 10m units sold one of the three largest automakers in the world. The product line ranges from subcompacts to luxury and sports vehicles to SUVs, trucks, minivans, and buses. Brands include Toyota Motor, Lexus, Daihatsu, and Hino.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Other business segments are financing services, IT services such as a web portal for automobile information, as well as the manufacturing of homes and boats. The company also owns a stake of around 25 percent in the part supplier Denso.

Toyota Motor Corp (7203.T) is with over 10m units sold one of the three largest automakers in the world. The product line ranges from subcompacts to luxury and sports vehicles to SUVs, trucks, minivans, and buses. Brands include Toyota Motor, Lexus, Daihatsu, and Hino.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Other business segments are financing services, IT services such as a web portal for automobile information, as well as the manufacturing of homes and boats. The company also owns a stake of around 25 percent in the part supplier Denso.

Toyota Motor is among Forbes Top Ten World’s Most Valuable Brands and 12th on Forbes Global 2000 list in 2018. The company is dedicated to paving the road for the future of mobility. Considerable investment has been made in Southeast Asia’s ride-hailing company Grab (1bn USD) and Uber (500m USD) to work on the development of self-driving cars jointly. A recently announced joint venture with Softbank to create new mobility services underpins the decisiveness of Toyota Motor to expand in new markets and to become a leading player in self-driving cars and related services as well as car sharing and electric vehicles.

Toyota Motor sells its vehicles in approximately 190 countries and regions. Japan is Toyota Motor’s largest market. Its market share in Japan is about 45 percent and accounts for 54 percent of the company’s total revenue. The market share in the US is around 14 percent. North America accounts for 37 percent of the company’s total revenue, followed by Asia with 18 percent and Europe with 11 percent.

Toyota Motor was founded in 1937 and is headquartered in Toyota City, Japan. The company is listed on the main board of Tokyo’s stock exchange since 1949. Its shares can also be traded in the US, UK, Germany, Singapore, Argentina, and Mexico. Major shareholder is the Japan Trustee Service Bank with an ownership of around 13 percent, followed by Toyota Motor itself with an ownership of about 8 percent. None of the board members owns more than one percent of the shares. 74 percent of the shares are in public hand.

With a workforce of over 372 thousand employees, Toyota Motor reported revenues of 14,674bn JPY (130bn USD) and profits before tax of 1,549bn JPY (13.7bn USD) over the first half of its fiscal year 2018/19. This is an increase of 3.4 and 24 percent respectively compared to the same period a year ago. In the fiscal year 2017/18, revenues and profits increased by 6 and 19 percent respectively. The operating margin of around 7 percent is below the industry average. Toyota Motor’s cash reserves increased by 6 percent to 3,247bn JPY (28.7bn USD), while debts increased by 8 percent to 20,886bn JPY (185bn USD) over the first six months of its fiscal year 2018/19. The company shows a stable balance sheet with acceptable profitability and financial strength. The equity ratio is at 39 percent and the gearing, defined here as total liabilities to total equity, at 154 percent. Moody’s current rating of Toyota Motor is Aa3, which is still high quality with low credit risk, with a stable outlook. Next results will be announced in early February.

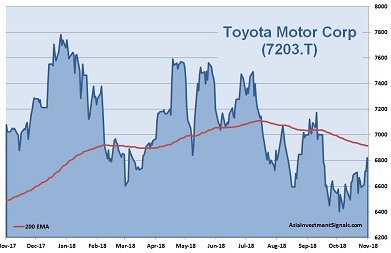

Toyota Motor’s shares are still in an uptrend since June 2016 and gained 37 percent in value since. Although the stock came down by 5 percent this year, it is bucking the negative trend since the end of October. The company is priced at 11 times earnings, 1.2 times book value and seven times cash flow. The latest dividend yielded more than 3 percent. 15 out of 22 analysts had a ‘buy’ or ‘outperform’ recommendations on the stock.

Our conclusion: Toyota Motor shows a stable balance sheet with acceptable profitability and financial strength. The valuation is reasonable. Revenues and profits grew by 4 and 7 percent over the last three years. Despite challenges, the company shows promising signs of transforming itself towards the new era of mobility. The company will be an important player in the coming years through cooperation and revolutionary technical innovations and should therefore not be ignored. Assuming a stable global economy, we expect the share price to increase between 15 to 20 percent over the next twelve months.

AIS Rating: ★★★★☆

| 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 H1 only |

|

|---|---|---|---|---|---|---|

| EPS (JPY) | 575 | 688 | 735 | 599 | 833 | 423 |

| Change | 89% | 20% | 7% | -19% | 39% | 19% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 11 | 19 | 1.2 | 7 | 39% | 11% | 154% | 3.1% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]