Dream International Limited (1126.HK) is one of the largest plush stuffed toy manufacturers in the world. The company produces plush toys according to customers’ brand names, cartoons, or animated characters on an ODM or OEM basis. Clients include well-known names such as Warner Bros., Disney, Bandai, Costco Wholesale Corporation, C & H Korea Group, and Funrise Toys. Dream International operates 22 plants in China and Vietnam.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] North America is the company’s largest market with a revenue share of 70 percent, followed by Japan with 14 percent. Europe contributes only 5 percent to the revenue and the other Asian countries to a bit over 7 percent.

Dream International Limited (1126.HK) is one of the largest plush stuffed toy manufacturers in the world. The company produces plush toys according to customers’ brand names, cartoons, or animated characters on an ODM or OEM basis. Clients include well-known names such as Warner Bros., Disney, Bandai, Costco Wholesale Corporation, C & H Korea Group, and Funrise Toys. Dream International operates 22 plants in China and Vietnam.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] North America is the company’s largest market with a revenue share of 70 percent, followed by Japan with 14 percent. Europe contributes only 5 percent to the revenue and the other Asian countries to a bit over 7 percent.

The majority of the revenue and profits are generated from the plastic figures business, which accounts for more than half of the company’s revenues and 43 percent of the profits. The plush toy segment accounts for about one-third of the company’s revenues and 40 percent of the profits. Despite significant growth in the die-casting products last year, this segment accounts for just 7 percent of the revenue and 4 percent of the profits. The new tarpaulin business, which was acquired in 2020, contributes 11 percent to the revenue and 13 percent to the profits.

Dream International was founded in 1984 and is headquartered in Hong Kong. The company is listed on the main board of Hong Kong’s stock exchange since 2002. Its shares can also be traded in Germany and the US. Major shareholder is the founder and CEO of the company, Mr. Kyoo Yoon Choi, who owns around 68 percent of the shares. Twenty-eight percent of the shares are in public hands.

With a workforce of almost 24 thousand employees, Dream International reported 3.8bn HKD (487m USD) revenues and profits before tax of 331m HKD (43m USD) in 2020. This is a decrease of 5 and 44 percent respectively compared to the same period a year ago. The decline is mainly due to the pandemic with lockdowns and low trading volumes in consequence. In 2019, revenues and profits were still up by 15 and 51 percent, respectively. The operating margin of around 8 percent is well above the industry average. Dream International’s cash reserves decreased by 16 percent to 489m HKD (63m USD), while debts and lease obligations jumped by 95 percent to 300m HKD (39m USD) in 2020.

The company still shows a healthy balance sheet with good profitability and financial strength. The equity ratio is 72 percent, and the gearing, defined here as total liabilities to total equity, at 32 percent. Nevertheless, Moody’s daily credit risk score for Dream International is at 7, indicating increased risk, based on the day-to-day movements in market value compared to the company’s liability structure. Next earning results will be announced at the end of August.

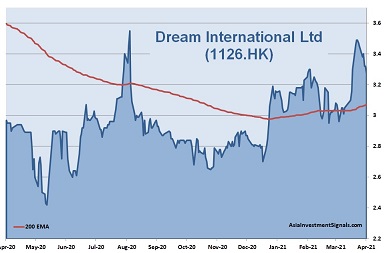

Dream International’s shares peaked in July 2018 and are down by 40 percent since. The share price shows currently signs of a turnaround and increased already by 16 percent this year. The company is priced at eight times earnings, 0.9 times book value, and at seven times operating cash flow. The forward dividend yield is roughly 4 percent. The stock has no analyst coverage.

Our conclusion: Dream International shows a healthy balance sheet with good profitability and financial strength. Despite the slump in growth last year, the valuation is low and comes with a long-term compounded annual growth rate for revenue and profits of 18 and 17 percent, respectively, over the last five years.

The toy industry faced a callous operating environment in 2020 due to the unprecedented challenges brought by the pandemic and the unresolved US-China trade tensions. Various lockdown measures worldwide have affected consumption sentiment significantly. The industry should therefore recover quickly once shops and amusement parks reopen. Amid the challenging environment, Dream International demonstrated its resilience underpinned by its leading position in the industry, diversified production bases, a new addition to the current product portfolio. Assuming a stable economy and a soon ending pandemic, we expect the share price to increase by 25 to 30 percent this year.

AIS Rating: ★★★★☆

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| EPS (HKDcents) | 22 | 44 | 60 | 49 | 71 | 40 |

| Change (%) | 23 | 96 | 37 | (18) | 44 | (43) |

| DPS (HKDcents) | 8 | 1 | 4 | 4 | 11 | 12 |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| 8 | 33 | 0.9 | 7 | 72 | 11 | 39 | 3.7 |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]