Fischer Tech Ltd (BDV.SI) is a specialist manufacturer of high volume precision engineering plastic components, laser marking and decorative finishing that are used for high-end electronic products and engineering components in the automotive, computer peripherals, medical healthcare and consumer product industries. The company has production facilities in Singapore, Malaysia, Thailand, and China.

Fischer Tech Ltd (BDV.SI) is a specialist manufacturer of high volume precision engineering plastic components, laser marking and decorative finishing that are used for high-end electronic products and engineering components in the automotive, computer peripherals, medical healthcare and consumer product industries. The company has production facilities in Singapore, Malaysia, Thailand, and China.

[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Fischer Tech’s clients include leading companies such as Abbott, HP, Sharp, Apple, JVC, Panasonic, Canon, Mitsubishi, Grundfos, Fisher & Paykel, Baxter, TRW, and BHTC. The company was founded in 1994 and is headquartered in Singapore. It is listed on the main board of Singapore’s SGX since 2001. Harmony (S) Holdings Pte Ltd owns around 57% of Fischer Tech’s shares.

With around 1900 employees Fisher Tech generated revenues of 188m SGD and net profits of 13m SGD in its fiscal year ending March 2016. This is not only an increase of 12% and 73% respectively compared to the previous year, but also a record result for the company. Both revenues and net profits have been on an upward trajectory since 2012, the year where operations were strongly hit by major natural disasters in the region.

Further growth opportunities are further to come from China, where the company has just recently launched a 20m SGD manufacturing facility in Suzhou to meet the demand of the world’s largest car market. A Global Platform program supports furthermore the marketing efforts of the company to become the partner of choice to many automotive manufacturers worldwide. With improvements in efficiency and productivity, the company also has room for further growth in profits as operating and net profit margins are only inferior to those of its industry peers.

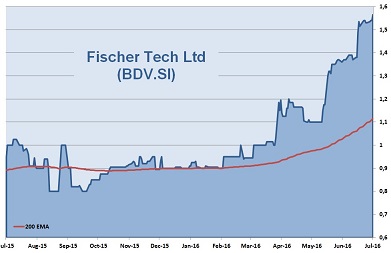

The company shows a stable growth and a solid performance with a share currently prices at only 6.5 times its earnings. The stock is in a continuous uptrend since beginning 2012 with a gain of more than 650%. Despite a relatively small market capitalization of only 86m SGD, the company is a solid investment with moderate downside risks.

AIS Rating: ★★★★☆

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|

| EPS (SGDcents) | 2.3 | -7.7 | 18.9 | 12.2 | 13.7 | 23.7 |

| Change | -10% | -442% | 345% | -36% | 13% | 73% |

| P/E | P/E Industry |

P/B | P/CF | Equity Ratio* |

ROE | Debt/ Capital |

Div YLD |

|---|---|---|---|---|---|---|---|

| 7 | 22 | 0.8 | 4 | 69% | 13% | 46% | 3.3% |

[/mepr-active]