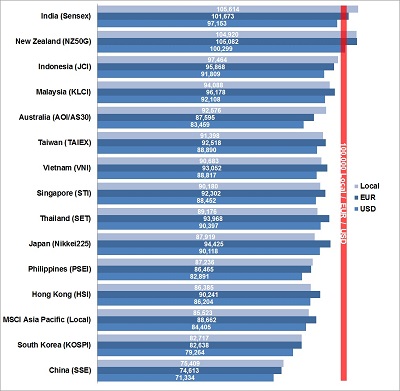

What would have a 100K USD, EUR or local currency investment returned to an investor in 2018 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock markets on a USD, EUR, and local currency basis.

What would have a 100K USD, EUR or local currency investment returned to an investor in 2018 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock markets on a USD, EUR, and local currency basis.

The highest returns with 6 and 5 percent would have made a local investor with Indian and New Zealand stocks in 2018.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The biggest loss with 29 percent would have experienced a USD based investor with Chinese shares.

No USD based investor had made a profit in any Asia-Pacific markets last year unless he or she would have been an excellent stock picker. A EUR based investor at least would have made 5 percent in the New Zealand market and 2 percent in the Indian market.

China, Hong Kong, and South Korea have been the worst performing markets in Asia-Pacific last year dragging down also massively the performance of the overall MSCI Asia-Pacific index. Relatively stable remained the Indonesian market with a loss of only 3 percent for a local investor.

Many Asia-Pacific markets followed the worldwide downturn of stocks in the fourth quarter of last year. Japan is leading the negative list with a loss of 17 percent during these last three months, followed by South Korea with 13 percent. Vietnam, Taiwan, China, Thailand, and Australia also experienced double-digit losses between 10 and 12 percent over that last quarter. Only Indonesia, the Philippines, and India were able to withstand this global downtrend.

Which will be the best-performing Asia-Pacific markets in 2019? Many analysts have made their predictions. Let’s see the market momentum during January. The performance and ranking during the first month of the year can give some indication for the developments of the upcoming months. Stay tuned and don’t miss our next performance snapshot which we post early February.

[/mepr-active]