The month of January is supposed to have high predictive power for the stock market performance for the rest of the year. In this regard, we can expect a good year ahead. Since beginning January, the MSCI Asia Pacific Index is up 6 percent (after a decline of 14 percent in 2018).[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] However, some skepticism remains. Economies around the world are cooling down. The US Fed plans no further rise of interest rates in the next time, a sign of a moderate economic outlook. Europe’s central bank sticks to its zero interest rate policy as growth expectation remains low.

The month of January is supposed to have high predictive power for the stock market performance for the rest of the year. In this regard, we can expect a good year ahead. Since beginning January, the MSCI Asia Pacific Index is up 6 percent (after a decline of 14 percent in 2018).[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] However, some skepticism remains. Economies around the world are cooling down. The US Fed plans no further rise of interest rates in the next time, a sign of a moderate economic outlook. Europe’s central bank sticks to its zero interest rate policy as growth expectation remains low.

On the one hand, low interest rates are a sign of a slowing down economy. Corporate profits are not expected to grow much in such an environment. On the other hand, a loose monetary policy continues to feed the equity markets with abundant liquidity.

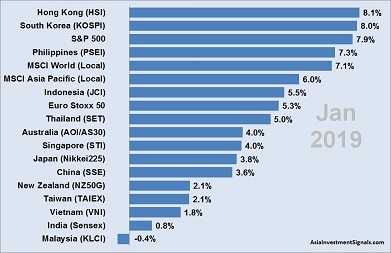

Which APAC market will attract the capital this year? Our regular APAC performance ranking shows that the best-performing market in the Asia Pacific region in January has been Hong Kong. The Hong Kong HSI showed the best January performance already for the third year in a row and increased by more than 8 percent in this first month of the year. The Hong Kong market recovered partly from its losses of 14 percent in 2018. Main drivers have been pharmaceutical and property companies which increased between 17 and 36 percent in January alone.

The second best-performing APAC market has been South Korea with an increase of 8 percent in January (after declining 17 percent in 2018), followed by the Philippines which gained over 7 percent (minus 13 percent in 2018). China, which lost 25 percent last year, gained roughly 4 percent in January as a result of the ongoing trade dispute with the US. An investment in the five worst performers of 2018 would have returned more than 6 percent in January only.

On the lower end of our APAC market performance ranking is Vietnam which gained roughly 2 percent in January. India, the big winner in Asia Pacific in 2018, advanced by approximately 1 percent only, while Malaysia has been the only APAC market with a loss in January (minus 0.4 percent).

In comparison, the S&P 500 index rose almost 8 percent in January (minus 6 percent in 2018), Euro Stoxx 50 advanced more than 5 percent (minus 14 percent in 2018), and the MSCI World index increased by more than 7 percent (minus 9 percent in 2018).

We expect Hong Kong, South Korea, and Singapore to continue performing well during the next months. All three countries have still reasonably priced markets regarding p/e ratio. China could awaken from its lethargy once the trade dispute with the US is settled.

[/mepr-active]