Shanghai Fudan Microelectronics Group Co Ltd (1385.HK) is a leading company for IC products in China. The company designs, developments and sells application-specific integrated circuits, such as contact and contactless chips for security and ID cards, chips for public transportation, social security, citizen and residential smart cards and chips for electronic payment cards.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Furthermore smart meter ASIC chips, non-volatile memory chips, and specific analog circuits. Shanghai Fudan Microelectronics also offers testing services for IC products.

Shanghai Fudan Microelectronics Group Co Ltd (1385.HK) is a leading company for IC products in China. The company designs, developments and sells application-specific integrated circuits, such as contact and contactless chips for security and ID cards, chips for public transportation, social security, citizen and residential smart cards and chips for electronic payment cards.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Furthermore smart meter ASIC chips, non-volatile memory chips, and specific analog circuits. Shanghai Fudan Microelectronics also offers testing services for IC products.

Shanghai Fudan Microelectronics operates mostly within its domestic market. Only 4% of the revenues are generated outside of China. Due to its links to Shanghai’s prestigious Fudan University and state-own enterprises, the company benefits from government projects and various grants to support its technology development in China.

Shanghai Fudan Microelectronics was founded in 1998 and is headquartered in Shanghai. The shares are listed on the main board of Hong Kong’s stock exchange since 2000 and can also be traded in Germany and the US. Major shareholders are Shanghai Fudan High Tech Company and Bailian Group Company Ltd, two state-owned enterprises, with an ownership of together 35%. On board also Shanghai’s prestigious Fudan University with an ownership of around 17%. 43% of the shares are in public hand.

With a workforce of 1,045 employees, Shanghai Fudan Microelectronics reported revenues of 589m RMB (88m USD) and profits before tax of 128m RMB (19m USD) over the first half of 2017. This is an increase of 22% and 27% respectively compared to the same period a year ago. In 2016, revenues and profits increased by 14% and 34% respectively compared to the year before. The operating margin of 52% is well above industry average. Shanghai Fudan Microelectronics had cash reserves of 318m RMB (48m USD) at the end of June 2017. The company shows a solid balance sheet with an equity ratio of 81% and a gearing, defined here as total liabilities to total equity, of only 23%.

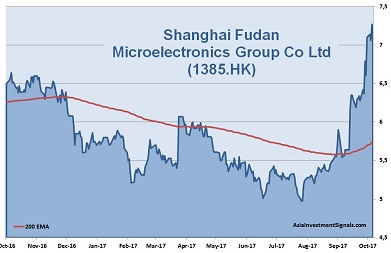

Shanghai Fudan Microelectronics’ shares are in an uptrend since August this year and gained 44% in value since, though the year-to-date performance has been ‘only’ 23%. The share price has reached a 52-week high just recently. The company is currently priced at 17 times earnings, which is in line with its peer sector. Shares trade at three times book value and at 16 times operating cash flow. The company did not pay any dividends for the last two years.

Government and academic links of the company will secure a steady flow of state projects and further grants for research and development activities. The company seems well managed and shows a stable growth of its business over the last ten years. More overseas expansion activities could be announced soon as the market for IC products is growing worldwide. The company is confident to keep a steady growth in its results for the second half of this year. We expect the share price to increase another 20% over the next six months.

AIS Rating: ★★★★☆

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 H1 only |

|

|---|---|---|---|---|---|---|

| EPS (RMB) | 22.7 | 25.8 | 27.2 | 25.7 | 34.4 | 16.9 |

| Change | 32% | 14% | 5% | -5% | 34% | 23% |

| P/E | P/E SECTOR |

P/B | P/CF | Equity Ratio* |

ROE | LIAB./ Equity** |

Div YLD |

|---|---|---|---|---|---|---|---|

| 17 | 17 | 2.9 | 16 | 81% | 19% | 23% | n/a |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]