Three more months until year-end. Time for our quarterly resume and outlook for the Asia-Pacific stock markets for the remaining period. October is known as the month with the highest volatility in the year. November and December, on the other hand, are mostly well-performing months due to the tendency for a year-end rally.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Three more months until year-end. Time for our quarterly resume and outlook for the Asia-Pacific stock markets for the remaining period. October is known as the month with the highest volatility in the year. November and December, on the other hand, are mostly well-performing months due to the tendency for a year-end rally.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

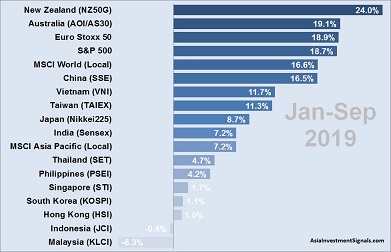

Our stock market performance ranking shows New Zealand, Australia, and China among the top three performing markets in the Asia-Pacific region so far with gains of around 24, 19, and 17 percent, respectively.

New Zealand’s stock market started slowly in January and picked up a steady momentum throughout the following months. It increased by almost 12 percent over Q1 and continued to advance another 7 percent in Q2 and 4 percent in Q3. Australia started the year with a very dynamic performance of almost 10 percent in Q1, continued to advance 7 percent in Q2 and 2 percent in Q3. Despite the trade dispute with the US, China did not show too many signs of weakness in its stock market. China started with a whopping 24 percent gain in Q1 and lost just about 4 and 2 percent over Q2 and Q3, respectively.

Only two countries produced losses in Asia-Pacific so far: Malaysia and Indonesia. Indonesia showed a promising performance of almost 6 percent in January but gave up those gains entirely over the following months. Malaysia stock market declined over 6 percent so far. However, other than Indonesia, Malaysia stayed in the red throughout all quarters so far.

Hong Kong’s and Singapore’s stock markets have been beaten down the most in Asia-Pacific in Q3 and have advanced by only one and two percent respectively this year. Both markets suffer heavily from the ongoing US-China trade disputes. Besides that, Hong Kong’s increasingly violent demonstrations provide further uncertainties among investors. Hong Kong and Singapore have currently the lowest valuation in Asia-Pacific in terms of p/e ratio. As soon as the US-China trade negotiations show some signs of a positive outcome, and the situation in Hong Kong’s streets calms down, we expect both markets to have considerable upside potential.

The MSCI Asia-Pacific Index gained 7.2 percent on a local currency base and 6.6 percent on a USD base this year. For comparison reason, we have also included the MSCI World, the S&P 500, and the EURO STOXX 50 Index in the ranking.

[/mepr-active]