Pessimists are seeing the downturn as a major disaster, optimists as a great buying opportunity. Who is going to be right? We can only tell in a few months. It is currently hard to predict if we have already seen a bottom or if stock prices will take another dive in the next weeks or months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Much will depend on how the world, and especially the strongly affected developed countries, will bring the pandemic under control. Most stock markets around the world have reached bearish levels, which is, by definition, a decline of 20 percent or more from their latest highs. Much of this market downturn is still psychology rather than hard facts. Scientists need to do more research, and people need time to adapt and deal with the new situation. It is not the first pandemic in human history. But the longer it takes to adjust to this new challenge, the more the global economy will suffer.

Pessimists are seeing the downturn as a major disaster, optimists as a great buying opportunity. Who is going to be right? We can only tell in a few months. It is currently hard to predict if we have already seen a bottom or if stock prices will take another dive in the next weeks or months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Much will depend on how the world, and especially the strongly affected developed countries, will bring the pandemic under control. Most stock markets around the world have reached bearish levels, which is, by definition, a decline of 20 percent or more from their latest highs. Much of this market downturn is still psychology rather than hard facts. Scientists need to do more research, and people need time to adapt and deal with the new situation. It is not the first pandemic in human history. But the longer it takes to adjust to this new challenge, the more the global economy will suffer.

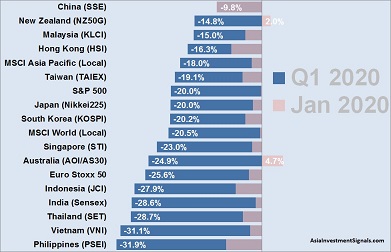

Our quarterly ranking shows the performance of the major stock market indices in the Asia Pacific region at the end of the first quarter. Surprisingly, China, the epicenter of the pandemic, was hardly hit by the global downturn. China experienced a loss of 10 percent already at the end of January and remained at this same level at the end of this first quarter. New Zealand, Malaysia, and Hong Kong also showed moderate losses between 10 and 16 percent and have been less affected than many other Asian markets.

On the lower end of the ranking are Indonesia, India, Thailand, Vietnam, and the Philippines, with losses of 28 percent and more. Mostly countries with fragile economies that are highly at risk with the duration of the worldwide restrictions.

[/mepr-active]