China Feihe Ltd (6186.HK) is the largest domestic baby formula producer in China. The company sells especially infant milk formula products. It also offers a range of other dairy products, including adult milk powder, liquid milk, adult goat milk powder, rice powder dietary supplement products, as well as nutritional supplements.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

China Feihe Ltd (6186.HK) is the largest domestic baby formula producer in China. The company sells especially infant milk formula products. It also offers a range of other dairy products, including adult milk powder, liquid milk, adult goat milk powder, rice powder dietary supplement products, as well as nutritional supplements.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Since the melamine poisoning scandal 12 years ago, the baby formula market in China has been dominated by foreign suppliers. However, consumers are slowly regaining confidence and are increasingly buying local products. Domestic producers have recaptured a market share of over 40 percent. China Feihe, which was not involved in the scandal, aims for a market share of 30 percent by 2023. The baby formula business in China is extremely profitable. 80% of Chinese families rely on formula rather than breast milk. China Feihe sells its products through offline distributors and e-commerce platforms, such as Tmall, JD.com, Suning.com, and its website and mobile application, including WeChat. The company operates a distribution network of about 1,800 offline customers with 109,000 retail points of sale.

China Feihe just recently acquired one of China’s largest fresh milk suppliers, YuanShengTai Dairy Farm. The takeover is supposed to secure a high-quality fresh milk supply and the growing demand for its milk formula products. Ninety-eight percent of China Feihe’s revenues are generated in Mainland China. The company’s High-End infant milk products made up for about 80 percent of revenues and profits and grew by more than 70 percent over the first six months of this year. The overall profit margin: A whopping 70 percent.

China Feihe was founded in 1962 and is headquartered in Qiqihar, China. The company was already listed on the New York stock exchange before it was taken private in 2013. It went public again with a listing on Hong Kong’s stock exchange’s main board in November 2019. Its shares can also be traded in the US. Major shareholder is the chairman, Mr. Leng Youbin, with a holding of roughly 50 percent, followed by Morgan Stanley with about 16 percent. Over 30 percent of the shares are in public hands.

With over 5,600 employees, China Feihe reported revenues of 8.7bn RMB (1.3bn USD) and profits before tax of 3.97bn RMB (592m USD) over the first half-year 2020. This is an increase of 48 and 61 percent respectively compared to the same period a year ago. For the full year 2019, revenues and profits increased by 32 and 78 percent, respectively. The operating margin of 43 percent is well above industry average. China Feihe’s cash reserves increased by 43 percent to 10.6bn RMB (1.6bn USD), while debts and lease obligations decreased by 87 percent to 396m RMB (59m USD) over the first half-year 2019 ending June.

China Feihe shows a solid balance sheet with good profitability and financial strength. The equity ratio is 64 percent, and the gearing, defined here as total liabilities to total equity, at 57 percent. The next earning results will be announced at the end of March 2021.

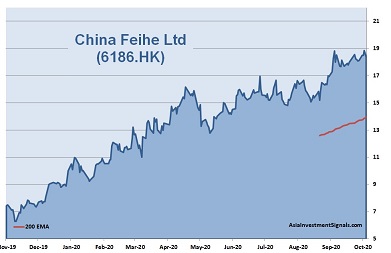

China Feihe’s shares are in an uptrend since its IPO in November last year and gained almost 150 percent in value since. The company is currently priced at 31 times earnings, 11 times book value, and 21 times operating cash flow. The forward dividend yield is 1.8 percent. 7 out of 11 analysts have a ‘buy’ or ‘outperform’ recommendations on the stock with an average target price of 21.7 HKD.

Our conclusion: China Feihe shows healthy financial positions with good profitability and financial strength. The valuation is high but comes with a consistent compounded annual growth rate of 59 and 108 percent for revenue and profits over the last three years. The outlook for the baby food industry in China is positive, with an expected growth rate of over six percent annually for the next five years. China Feihe is well-positioned in a strong competitive environment. Assuming continued stable economic conditions in China, we expect the share price to increase another 15 to 20 percent over the next six months.

AIS Rating: ★★★★☆

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 H1 Only |

|

|---|---|---|---|---|---|---|

| EPS (RMB) | 0.05 | 0.05 | 0.14 | 0.28 | 0.48 | 0.3 |

| Change (%) | 1 | 178 | 93 | 73 | 36 | |

| DPS (HKD) | n/a | n/a | n/a | n/a | 0.19 | 0.14 |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| 31 | 19 | 11 | 21 | 64% | 42% | 57% | 1.8% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]