Three months left until year-end. Time for our quarterly resume for Asia-Pacific’s stock markets for the remaining period. October is statistically known as the month with the highest volatility in the year. November and December as two well-performing months due to the tendency for a year-end rally. But the upcoming US presidential election and the further development of the pandemic might override these statistics. The outcome remains more than uncertain.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Three months left until year-end. Time for our quarterly resume for Asia-Pacific’s stock markets for the remaining period. October is statistically known as the month with the highest volatility in the year. November and December as two well-performing months due to the tendency for a year-end rally. But the upcoming US presidential election and the further development of the pandemic might override these statistics. The outcome remains more than uncertain.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

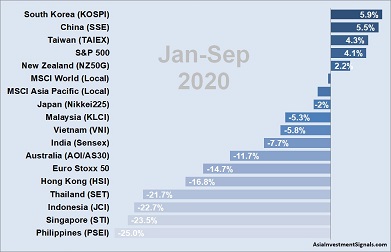

Looking back this year, Asia-Pacific’s stock market performance ranking shows South Korea, China, Taiwan, and New Zealand as the only stock markets in this region, which produced a positive return since the beginning of this year.

After losing more than 20 percent in the big sell-off in March, South Korea’s stock market bounced back 20 percent in Q2 and advanced another 10 percent in Q3, which puts it on the top of our performing ranking in the Asia-Pacific region so far this year.

Despite the pandemic’s epicenter and the strict lockdown imposed after the virus outbreak, most of China’s economy returned to a normal level relatively fast. Surprisingly, China’s lost roughly 10 percent in Q1 only and recovered 17 percent over Q2 and Q3 to end up second in our Asia-Pacific performance ranking so far.

The Taiwanese stock market dropped about 20 percent in the big sell-off in March but rebounded about 29 percent over Q2 and Q3 to end up third in our ranking.

New Zealand plunged about 19 percent in March, recovered around 20 percent over the next six months, and end up with a positive return of more than 2 percent so far this year.

The Vietnamese stock market dropped with over 33 percent the most in the big sell-off in March. But it also showed the most robust recovery of about 37 percent over the last six months in Asia-Pacific.

Countries with the most significant losses in Asia-Pacific have been the Philippines, Singapore, Indonesia, and Thailand. They were among the worst-hit markets in the big sell-off in March and were only able to recover marginally from their lows.

The MSCI Asia-Pacific Index lost 1.5 percent on a local currency base and 0.4 percent on a USD base over the first nine months of this year. For comparison, we also included the MSCI World, the S&P 500, and the EURO STOXX 50 Index.

[/mepr-active]