Nintendo Co. Ltd. (7974.T) is one of the most recognizable brands in gaming. The company is both a developer and publisher of video games and a manufacturer of home and handheld game consoles. Nintendo started some 130 years ago with handmade Japanese playing cards and is today among the top three video game makers globally and number one of game console sales.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company has produced some of the most successful consoles in the video game industry, such as the Game Boy, the Super Nintendo Entertainment System, the Wii, and the Nintendo Switch. Nintendo has also released some of the most beloved blockbuster video games, such as Super Mario, Donkey Kong, The Legend of Zelda, and Pokémon. Some are bestsellers for 35 years already. Nintendo is on Forbes’ list of the World’s Most Valuable Brands 2020 and the list of the Global 2000 companies.

Nintendo Co. Ltd. (7974.T) is one of the most recognizable brands in gaming. The company is both a developer and publisher of video games and a manufacturer of home and handheld game consoles. Nintendo started some 130 years ago with handmade Japanese playing cards and is today among the top three video game makers globally and number one of game console sales.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The company has produced some of the most successful consoles in the video game industry, such as the Game Boy, the Super Nintendo Entertainment System, the Wii, and the Nintendo Switch. Nintendo has also released some of the most beloved blockbuster video games, such as Super Mario, Donkey Kong, The Legend of Zelda, and Pokémon. Some are bestsellers for 35 years already. Nintendo is on Forbes’ list of the World’s Most Valuable Brands 2020 and the list of the Global 2000 companies.

Nintendo’s successful Switch platform accounted for around 93 percent of its revenue and grew by 19 percent last year. Sales of the 3DS platform have been less successful in recent years. 3DS accounts for only 3 percent of the revenues and will therefore be discontinued after nearly a decade. The US is Nintendo’s largest geographic market, accounting for 37 percent of its sales, followed by Europe with 25 and Japan with 23 percent. Japan had with 13 percent the strongest growth last year.

Nintendo was founded in 1889 and is headquartered in Kyoto, Japan. The company is listed on Osaka’s and Kyoto’s stock exchange since 1962, and on the First Section of Tokyo’s stock exchange since 1983. The shares can also be traded in Germany, Austria, Mexico, the UK, and the US. The company itself holds about ten percent of the shares. Free flow is about eighty-six percent.

With a workforce of 6,200 employees, Nintendo reported revenues of 358bn JPY (3.4bn USD) and profits before tax of 150bn JPY (1.4bn USD) during the first three months of its fiscal year 2020/21. This is an increase of 108 and 574 percent, respectively, compared to the same period a year ago. The company benefits enormously from the stay-at-home trend during the pandemic. In the fiscal year 2019/20, revenues and profits increased by 9 and 33 percent, respectively. The operating margin is expanding and is with 31 percent, well above industry average. Nintendo’s cash reserves increased by 2.6 percent to 914bn JPY (8.7bn USD) over the first three months of its fiscal year 2020/21. The company has no debts.

Nintendo shows a solid balance sheet with excellent profitability and financial strength. The equity ratio is at 79 percent, and the gearing, defined here as total liabilities to total equity, at low 27 percent only. Moody’s daily credit risk score for Nintendo is 2, indicating a low risk, based on the day-to-day movements in market value compared to its liability structure. The next earning results will be announced in early November.

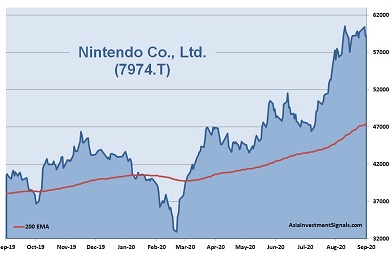

Nintendo’s shares are in an uptrend since April 2019 and gained 69 percent in value since, 34 percent increase alone this year. The company is currently priced at 20 times earnings, 4.5 times book value, and at 20 times operating cash flow. The forward dividend yield is about 1.9 percent. 17 out of 21 analysts have a ‘buy’ or ‘outperform’ recommendations on the stock.

Our conclusion: Nintendo shows healthy financial positions with excellent profitability and financial strength. The valuation is still ok and comes with a consistent compounded annual growth rate for revenue and profits of 39 and 37 percent, respectively, over the last three years. The interactive entertainment industry has been steadily growing in recent years. New advancements in technology, particularly on mobile devices, should propel game sales over the next decade.

Nintendo is well positioned in a strong competitive environment. One of its most significant advantages is creating unique gaming experiences with exclusive titles that players cannot find anywhere else. And Nintendo is benefiting strongly from the stay-at-home trend during the pandemic. It will thus also attract new players. We expect the share price to increase by another 10 percent this year and 20 percent over the next twelve months. Definitely a buy!

AIS Rating: ★★★★☆

| 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | 2020/21 Q1 Only |

|

|---|---|---|---|---|---|---|

| EPS (JPY) | 137 | 854 | 1162 | 1616 | 2171 | 894 |

| Change (%) | (61) | 521 | 36 | 39 | 34 | 541 |

| DPS (JPY) | 150 | 430 | 590 | 810 | 1090 | n/a |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| 20 | 31 | 4.5 | 20 | 79% | 24% | 27% | 1.9% |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]